Page 26 - DECO201_MACRO_ECONOMICS_ENGLISH

P. 26

Unit 2: National Income

between the value of output produced by that firm and the total expenditure incurred by it on Notes

the materials and intermediate products purchased from other business firms. Thus, value added

is obtained by deducting the value of material inputs or intermediate products from the

corresponding value of output.

Value added = Total sales + Closing stock of finished and semi-finished goods - Total expenditure

on raw materials and intermediate products - Opening stock of finished and semi-finished

goods

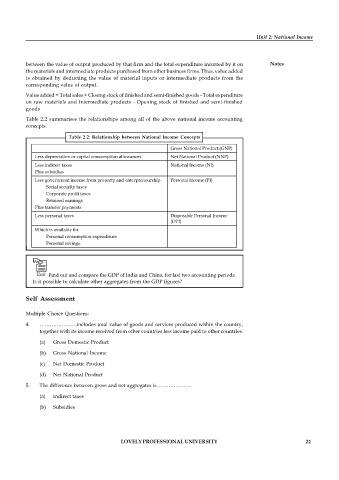

Table 2.2 summarises the relationships among all of the above national income accounting

concepts.

Table 2.2: Relationship between National Income Concepts

Gross National Product (GNP)

Less depreciation or capital consumption allowances Net National Product (NNP)

Less indirect taxes National Income (NI)

Plus subsidies

Less government income from property and enterpreneurship Personal Income (PI)

Social security taxes

Corporate profit taxes

Retained earnings

Plus transfer payments

Less personal taxes Disposable Personal Income

(DPI)

Which is available for

Personal consumption expenditure

Personal savings.

Task Find out and compare the GDP of India and China, for last two accounting periods.

Is it possible to calculate other aggregates from the GDP figures?

Self Assessment

Multiple Choice Questions:

4. ………………….includes total value of goods and services produced within the country,

together with its income received from other countries less income paid to other countries.

(a) Gross Domestic Product

(b) Gross National Income

(c) Net Domestic Product

(d) Net National Product

5. The difference between gross and net aggregates is…………………

(a) Indirect taxes

(b) Subsidies

LOVELY PROFESSIONAL UNIVERSITY 21