Page 38 - DECO201_MACRO_ECONOMICS_ENGLISH

P. 38

Unit 2: National Income

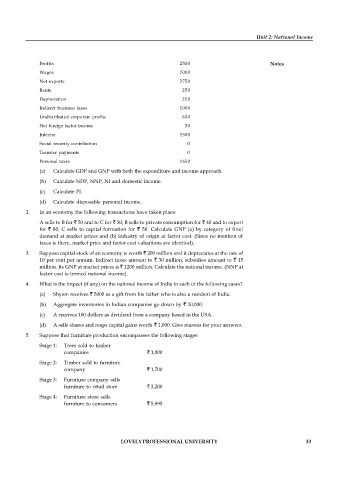

Profits 2500 Notes

Wages 7000

Net exports 2750

Rents 250

Depreciation 250

Indirect business taxes 1000

Undistributed corporate profits 600

Net foreign factor income 30

Interest 1500

Social security contribution 0

Transfer payments 0

Personal taxes 1650

(a) Calculate GDP and GNP with both the expenditure and income approach.

(b) Calculate NDP, NNP, NI and domestic income.

(c) Calculate PI.

(d) Calculate disposable personal income.

2. In an economy the following transactions have taken place:

A sells to B for 50 and to C for 30; B sells to private consumption for 40 and to export

for 80; C sells to capital formation for 50. Calculate GNP (a) by category of final

demand at market prices and (b) industry of origin at factor cost. (Since no mention of

taxes is there, market price and factor cost valuations are identical).

3. Suppose capital stock of an economy is worth 200 million and it depreciates at the rate of

10 per cent per annum. Indirect taxes amount to 30 million, subsidies amount to 15

million. Its GNP at market prices is 1200 million. Calculate the national income. (NNP at

factor cost is termed national income).

4. What is the impact (if any) on the national income of India in each of the following cases?

(a) Shyam receives 5000 as a gift from his father who is also a resident of India.

(b) Aggregate inventories in Indian companies go down by 20,000.

(c) A receives 100 dollars as dividend from a company based in the USA.

(d) A sells shares and reaps capital gains worth 1,000. Give reasons for your answers.

5. Suppose that furniture production encompasses the following stages:

Stage 1: Trees sold to timber

companies 1,000

Stage 2: Timber sold to furniture

company 1,700

Stage 3: Furniture company sells

furniture to retail store 3,200

Stage 4: Furniture store sells

furniture to consumers 5,995

LOVELY PROFESSIONAL UNIVERSITY 33