Page 177 - DMGT207_MANAGEMENT_OF_FINANCES

P. 177

Management of Finances

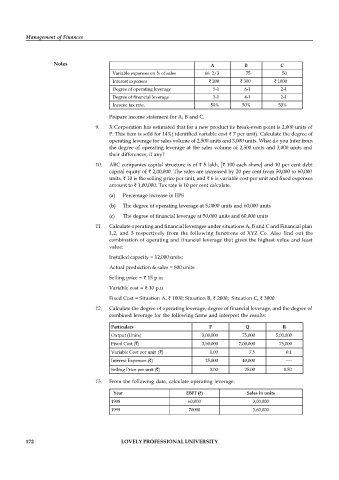

Notes A B C

Variable expenses on % of sales 66 2/3 75 50

Interest expenses 200 300 1000

Degree of operating leverage 5-1 6-1 2-1

Degree of financial leverage 3-1 4-1 2-1

Income tax rate. 50% 50% 50%

Prepare income statement for A, B and C.

9. X Corporation has estimated that for a new product its break-even point is 2,000 units of

P. This item is sold for 14%( identified variable cost 7 per unit). Calculate the degree of

operating leverage for sales volume of 2,500 units and 3,000 units. What do you infer from

the degree of operating leverage at the sales volume of 2,500 units and 3,000 units and

their differences, if any?

10. ABC companies capital structure is of 5 lakh, [ 100 each share] and 10 per cent debt

capital equity of 2,00,000. The sales are increased by 20 per cent from 50,000 to 60,000

units. 10 is the selling price per unit, and 6 is variable cost per unit and fixed expenses

amount to 1,00,000. Tax rate is 10 per cent calculate.

(a) Percentage increase in EPS

(b) The degree of operating leverage at 5,0000 units and 60,000 units

(c) The degree of financial leverage at 50,000 units and 60,000 units

11. Calculate operating and financial leverages under situations A, B and C and Financial plan

1,2, and 3 respectively from the following functions of XYZ Co. Also find out the

combination of operating and financial leverage that gives the highest value and least

value:

Installed capacity = 12,000 units;

Actual production & sales = 800 units

Selling price = 15 p.u;

Variable cost = 10 p.u

Fixed Cost = Situation A, 1000; Situation B, 2000; Situation C, 3000

12. Calculate the degree of operating leverage, degree of financial leverage, and the degree of

combined leverage for the following firms and interpret the results:

Particulars P Q R

Output (Units) 3,00,000 75,000 5,00,000

Fixed Cost ( ) 3,50,000 7,00,000 75,000

Variable Cost per unit ( ) 1.00 7.5 0.1

Interest Expenses ( ) 25,000 40,000 ----

Selling Price per unit ( ) 3.00 25.00 0.50

13. From the following data, calculate operating leverage.

Year EBIT ( ) Sales in units

1998 60,000 3,00,000

1999 70000 3,60,000

172 LOVELY PROFESSIONAL UNIVERSITY