Page 190 - DMGT207_MANAGEMENT_OF_FINANCES

P. 190

Unit 8: Capital Structure Decision

curves are horizontal to X-axis. As the degree of leverage increases (% of debt in the total capital Notes

increase) overall cost of capital continuously falls. K is minimum when, there is 100% debt. So

o

optimum capital structure exists at 100% debt and 0% equity capital. But in practice, 100% debt

may not be possible. There should be some equity capital in the capital structure of any company.

8.7.2 Net Operating Income Approach

This theory is also given by David Durand. This is just the opposite to NI approach. According

to NOI approach, the capital structure decision is irrelevant and there is nothing like optimum

capital structure. All the capital structures are optimum.

According to this theory, the market value of the firm is not affected by the capital structure

changes. The market value of the firm is found by capitalizing (dividing) the net operating

income by the overall cost of capital, which is constant. The market value of the firm is obtained

by using the following formula.

EBIT

V

K o

The overall cost of capital depends on the business risks of the firm, which is assumed to be

constant. NOI depends on the investments made by the company and not on the capital structure

decisions. So, if NOI and K are constant, the value of the firm must remain same regardless of

o

leverage.

Assumptions

The market capitalizes the value of the firm as a whole. Thus, the split between debt and equity

is not important. The value of the firm is obtained by capitalizing NOI by the K , which depends

o

on the business risks. If business risks is constant, K is also constant.

o

The use of debt increases the risks of shareholders, So, K increases with the leverage and eats

e

completely the advantage of low cost debt.

1. Cost of debt remains same regardless of leverage.

2. Corporate income tax does not exist.

The critical assumptions of this approach are that K remains same regardless of the degree of

o

leverage. The market capitalizes the value of the firm as a whole and the split between debt and

equity is unimportant. The benefits from the increase in the use of cost debt is completely offset

(neutralised) by the increases in the cost of equity. So even if the leverage is increased, overall

cost of capital remains at the same level. When the company increases the leverage, the firm

becomes more risky and equity shareholders penalize the firm by demanding higher and higher

rate of returns. So, K is the function of the debt equity ratio. Since overall cost of capital structure

e

remains static according to the theory.

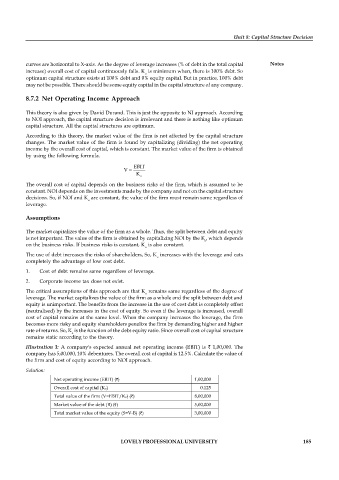

Illustration 3: A company's expected annual net operating income (EBIT) is 1,00,000. The

company has 5,00,000, 10% debentures. The overall cost of capital is 12.5%. Calculate the value of

the firm and cost of equity according to NOI approach.

Solution:

Net operating income (EBIT) ( ) 1,00,000

Overall cost of capital (Ko) 0.125

Total value of the firm (V=EBIT/Ko) ( ) 8,00,000

Market value of the debt (B) ( ) 5,00,000

Total market value of the equity (S=V-B) ( ) 3,00,000

LOVELY PROFESSIONAL UNIVERSITY 185