Page 267 - DMGT207_MANAGEMENT_OF_FINANCES

P. 267

Management of Finances

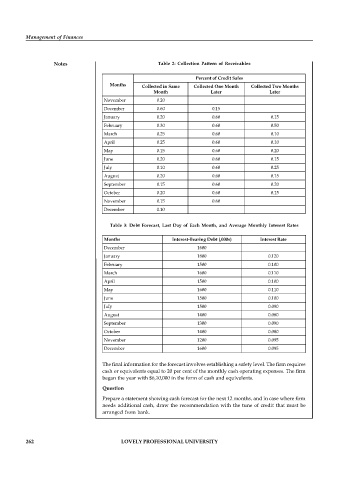

Notes Table 2: Collection Pattern of Receivables

Percent of Credit Sales

Months Collected in Same Collected One Month Collected Two Months

Month Later Later

November 0.20

December 0.60 0.15

January 0.20 0.60 0.15

February 0.30 0.60 0.50

March 0.25 0.60 0.10

April 0.25 0.60 0.10

May 0.15 0.60 0.20

June 0.20 0.60 0.15

July 0.10 0.60 0.25

August 0.20 0.60 0.15

September 0.15 0.60 0.20

October 0.20 0.60 0.15

November 0.15 0.60

December 0.10

Table 3: Debt Forecast, Last Day of Each Month, and Average Monthly Interest Rates

Months Interest-Bearing Debt (,000s) Interest Rate

December 1600

January 1800 0.120

February 1500 0.100

March 1600 0.110

April 1500 0.100

May 1600 0.110

June 1500 0.100

July 1500 0.090

August 1400 0.080

September 1300 0.090

October 1400 0.080

November 1200 0.095

December 1600 0.095

The final information for the forecast involves establishing a safety level. The firm requires

cash or equivalents equal to 20 per cent of the monthly cash operating expenses. The firm

began the year with $6,10,000 in the form of cash and equivalents.

Question

Prepare a statement showing cash forecast for the next 12 months, and in case where firm

needs additional cash, draw the recommendation with the tune of credit that must be

arranged from bank.

262 LOVELY PROFESSIONAL UNIVERSITY