Page 76 - DMGT207_MANAGEMENT_OF_FINANCES

P. 76

Unit 4: Risk and Return Analysis

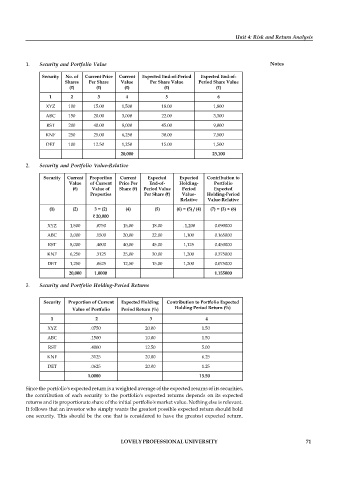

1. Security and Portfolio Value Notes

Security No. of Current Price Current Expected End-of-Period Expected End-of-

Shares Per Share Value Per Share Value Period Share Value

( ) ( ) ( ) ( ) ( )

1 2 3 4 5 6

XYZ 100 15.00 1,500 18.00 1,800

ABC 150 20.00 3,000 22.00 3,300

RST 200 40.00 8,000 45.00 9,000

KNF 250 25.00 6,250 30.00 7,500

DET 100 12.50 1,250 15.00 1,500

20,000 23,100

2. Security and Portfolio Value-Relative

Security Current Proportion Current Expected Expected Contribution to

Value of Current Price Per End-of- Holding- Portfolio

( ) Value of Share ( ) Period Value Period Expected

Properties Per Share ( ) Value- Holding-Period

Relative Value-Relative

(1) (2) 3 = (2) (4) (5) (6) = (5) / (4) (7) = (3) × (6)

20,000

XYZ 1,500 .0750 15,00 18.00 . 1,200 0.090000

ABC 3,000 .1500 20,00 22.00 1,100 0.165000

RST 8,000 .4000 40,00 45.00 1,125 0.450000

KNF 6,250 .3125 25,00 30.00 1,200 0.375000

DET 1,250 .0625 12,50 15.00 1,200 0.075000

20,000 1.0000 1.155000

3. Security and Portfolio Holding-Period Returns

Security Proportion of Current Expected Holding Contribution to Portfolio Expected

Value of Portfolio Period Return (%) Holding Period Return (%)

1 2 3 4

XYZ .0750 20.00 1.50

ABC .1500 10.00 1.50

RST .4000 12.50 5.00

KNF .3125 20.00 6.25

DET .0625 20.00 1.25

1.0000 15.50

Since the portfolio's expected return is a weighted average of the expected returns of its securities,

the contribution of each security to the portfolio's expected returns depends on its expected

returns and its proportionate share of the initial portfolio's market value. Nothing else is relevant.

It follows that an investor who simply wants the greatest possible expected return should hold

one security. This should be the one that is considered to have the greatest expected return.

LOVELY PROFESSIONAL UNIVERSITY 71