Page 171 - DECO502_INDIAN_ECONOMIC_POLICY_ENGLISH

P. 171

Unit 14: Rural Credit and Marketing

The organisation of the co-operative credit for short period is briefly outlined here : Notes

Primary Agricultural Credit Society : (PACS) A co-operative credit society, commonly known as the

primary agricultural credit society (PACS) may be started with ten or more persons, normally belonging

to a village. The value of each share is generally nominal so as to enable even the poorest farmer to

become a member. Primary Agricultural Credit Societies (PAC S) are the grassroot level arms of the

short-term cooperative credit strucure. PACS deal directly with farmer-borrowers, grant short term

and medium term loans and also undertake distribution and marketing functions.

The management of the society is under an elected body consisting of President, Secretary and

Treasurer. The management is honorary, the only paid member being normally the accountant (in

case the society is large and requires a paid whole-time accountant). Loans are given for short periods,

normally for one year, for carrying out agricultural operations, and the rate of interest is low. Profits

are not distributed as dividend to shareholders but are used for the welfare of the village, in the

construction of a well, or maintenance of the village school, and so on.

The usefulness of PACs has been rising steadily. In 1950-51, they advanced loans worth ` 23 crores;

this rose to ` 200 crores in 1960-61, and to ` 34,520 crores in 2000-01. The PACS have stepped up their

advances to the weaker sections particularly the small and marginal farmers. This progress has been

quite spectacular but not adequate considering the demand for finance from farmers. However, “the

primary credit society has continued to remain the weakest link in the entire co-operative structure.”

Restructuring of PACS : Considerable attention was given during the past few decades to build the

PACS into strong institutions. Such a structure, close to the farmers, is very essential for disbursing

rural credit, particularly to small farmers. A programme was introduced by the Government and RBI

to reorganise and revitalise the primary agricultural credit societies. It was completed in Rajasthan,

Orissa, Madhya Pradesh, Kerala, Tamil Nadu and Gujarat. In other States, it has not made much

headway.

The number of PACS had come down from 2,12,000 in 1960-61 to 1,61,000 in 1970-71 and 1,06,380 at

the end March 2006 with estimated membership of over 10 crore farmers.

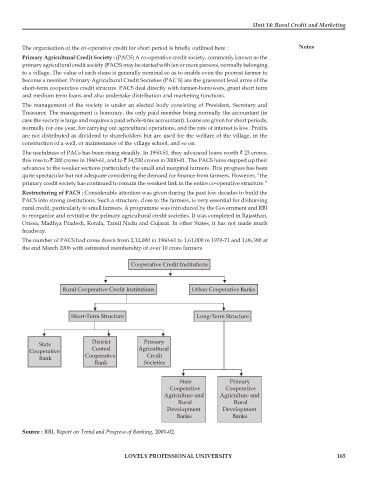

Cooperative Credit Institutions

Rural Cooperative Credit Institutions Urban Cooperative Banks

Short-Term Structure Long-Term Structure

District Primary

State

Central Agricultural

Cooperative

Cooperative Credit

Bank

Bank Societies

State Primary

Cooperative Cooperative

Agriculture and Agriculture and

Rural Rural

Development Development

Banks Banks

Source : RBI, Report on Trend and Progress of Banking, 2001-02.

LOVELY PROFESSIONAL UNIVERSITY 165