Page 255 - DECO502_INDIAN_ECONOMIC_POLICY_ENGLISH

P. 255

Unit 20: Indian Financial System: Money Market and Monetary Policy

Notes

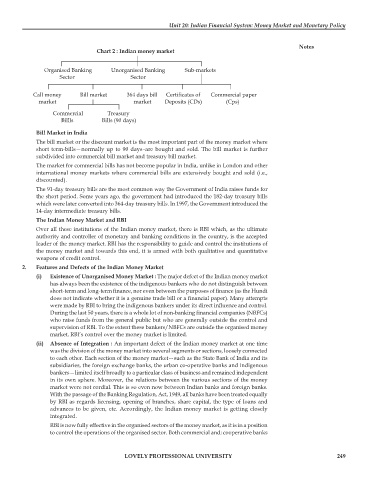

Chart 2 : Indian money market

Organised Banking Unorganised Banking Sub-markets

Sector Sector

Call money Bill market 364 days bill Certificates of Commercial paper

market market Deposits (CDs) (Cps)

Commercial Treasury

Billls Bills (90 days)

Bill Market in India

The bill market or the discount market is the most important part of the money market where

short term-bills—normally up to 90 days–are bought and sold. The bill market is further

subdivided into commercial bill market and treasury bill market.

The market for commercial bills has not become popular in India, unlike in London and other

international money markets where commercial bills are extensively bought and sold (i.e.,

discounted).

The 91-day treasury bills are the most common way the Government of India raises funds for

the short period. Some years ago, the government had introduced the 182-day treasury bills

which were later converted into 364-day treasury bills. In 1997, the Government introduced the

14-day intermediate treasury bills.

The Indian Money Market and RBI

Over all these institutions of the Indian money market, there is RBI which, as the ultimate

authority and controller of monetary and banking conditions in the country, is the accepted

leader of the money market. RBI has the responsibility to guide and control the institutions of

the money market and towards this end, it is armed with both qualitative and quantitative

weapons of credit control.

2. Features and Defects of the Indian Money Market

(i) Existence of Unorganised Money Market : The major defect of the Indian money market

has always been the existence of the indigenous bankers who do not distinguish between

short-term and long-term finance, nor even between the purposes of finance (as the Hundi

does not indicate whether it is a genuine trade bill or a financial paper). Many attempts

were made by RBI to bring the indigenous bankers under its direct influence and control.

During the last 50 years, there is a whole lot of non-banking financial companies (NBFCs)

who raise funds from the general public but who are generally outside the control and

supervision of RBI. To the extent these bankers/NBFCs are outside the organised money

market, RBI’s control over the money market is limited.

(ii) Absence of Integration : An important defect of the Indian money market at one time

was the division of the money market into several segments or sections, loosely connected

to each other. Each section of the money market—such as the State Bank of India and its

subsidiaries, the foreign exchange banks, the urban co-operative banks and indigenous

bankers—limited itself broadly to a particular class of business and remained independent

in its own sphere. Moreover, the relations between the various sections of the money

market were not cordial. This is so even now between Indian banks and foreign banks.

With the passage of the Banking Regulation, Act, 1949, all banks have been treated equally

by RBI as regards licensing, opening of branches, share capital, the type of loans and

advances to be given, etc. Accordingly, the Indian money market is getting closely

integrated.

RBI is now fully effective in the organised sectors of the money market, as it is in a position

to control the operations of the organised sector. Both commercial and; cooperative banks

LOVELY PROFESSIONAL UNIVERSITY 249