Page 304 - DECO503_INTERNATIONAL_TRADE_AND_FINANCE_ENGLISH

P. 304

International Trade and Finance

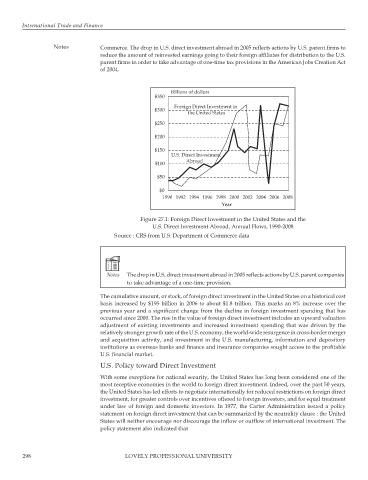

Notes Commerce. The drop in U.S. direct investment abroad in 2005 reflects actions by U.S. parent firms to

reduce the amount of reinvested earnings going to their foreign affiliates for distribution to the U.S.

parent firms in order to take advantage of one-time tax provisions in the American Jobs Creation Act

of 2004.

Billions of dollars

$350

Foreign Direct Investment in

$300

the United States

$250

$200

$150

U.S. Direct Investment

Abroad

$100

$50

$0

1990 1992 1994 1996 1998 2000 2002 2004 2006 2008

Year

Figure 27.1: Foreign Direct Investment in the United States and the

U.S. Direct Investment Abroad, Annual Flows, 1990-2008

Source : CRS from U.S. Department of Commerce data

The drop in U.S. direct investment abroad in 2005 reflects actions by U.S. parent companies

to take advantage of a one-time provision.

The cumulative amount, or stock, of foreign direct investment in the United States on a historical cost

basis increased by $195 billion in 2006 to about $1.8 trillion. This marks an 8% increase over the

previous year and a significant change from the decline in foreign investment spending that has

occurred since 2000. The rise in the value of foreign direct investment includes an upward valuation

adjustment of existing investments and increased investment spending that was driven by the

relatively stronger growth rate of the U.S. economy, the world-wide resurgence in cross-border merger

and acquisition activity, and investment in the U.S. manufacturing, information and depository

institutions as overseas banks and finance and insurance companies sought access to the profitable

U.S. financial market.

U.S. Policy toward Direct Investment

With some exceptions for national security, the United States has long been considered one of the

most receptive economies in the world to foreign direct investment. Indeed, over the past 50 years,

the United States has led efforts to negotiate internationally for reduced restrictions on foreign direct

investment, for greater controls over incentives offered to foreign investors, and for equal treatment

under law of foreign and domestic investors. In 1977, the Carter Administration issued a policy

statement on foreign direct investment that can be summarized by the neutrality clause : the United

States will neither encourage nor discourage the inflow or outflow of international investment. The

policy statement also indicated that

298 LOVELY PROFESSIONAL UNIVERSITY