Page 12 - DCOM101_FINANCIAL_ACCOUNTING_I

P. 12

Financial Accounting-I

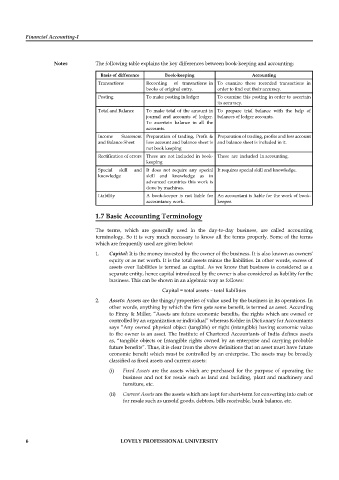

Notes The following table explains the key differences between book-keeping and accounting:

Basis of difference Book-keeping Accounting

Transactions Recording of transactions in To examine these recorded transactions in

books of original entry. order to find out their accuracy.

Posting To make posting in ledger To examine this posting in order to ascertain

its accuracy.

Total and Balance To make total of the amount in To prepare trial balance with the help of

journal and accounts of ledger. balances of ledger accounts.

To ascertain balance in all the

accounts.

Income Statement Preparation of trading, Profit & Preparation of trading, profits and loss account

and Balance Sheet loss account and balance sheet is and balance sheet is included in it.

not book keeping

Rectification of errors These are not included in book- These are included in accounting.

keeping

Special skill and It does not require any special It requires special skill and knowledge.

knowledge skill and knowledge as in

advanced countries this work is

done by machines.

Liability A book-keeper is not liable for An accountant is liable for the work of book-

accountancy work. keeper.

1.7 Basic Accounting Terminology

The terms, which are generally used in the day-to-day business, are called accounting

terminology. So it is very much necessary to know all the terms properly. Some of the terms

which are frequently used are given below:

1. Capital: It is the money invested by the owner of the business. It is also known as owners’

equity or as net worth. It is the total assets minus the liabilities. In other words, excess of

assets over liabilities is termed as capital. As we know that business is considered as a

separate entity, hence capital introduced by the owner is also considered as liability for the

business. This can be shown in an algebraic way as follows:

Capital = total assets – total liabilities

2. Assets: Assets are the things/properties of value used by the business in its operations. In

other words, anything by which the firm gets some benefit, is termed as asset. According

to Finny & Miller, “Assets are future economic benefits, the rights which are owned or

controlled by an organization or individual” whereas Kohler in Dictionary for Accountants

says “Any owned physical object (tangible) or right (intangible) having economic value

to the owner is an asset. The Institute of Chartered Accountants of India defines assets

as, “tangible objects or Intangible rights owned by an enterprise and carrying probable

future benefits”. Thus, it is clear from the above definitions that an asset must have future

economic benefit which must be controlled by an enterprise. The assets may be broadly

classified as fixed assets and current assets:

(i) Fixed Assets are the assets which are purchased for the purpose of operating the

business and not for resale such as land and building, plant and machinery and

furniture, etc.

(ii) Current Assets are the assets which are kept for short-term for converting into cash or

for resale such as unsold goods, debtors, bills receivable, bank balance, etc.

6 LOVELY PROFESSIONAL UNIVERSITY