Page 263 - DMGT401Business Environment

P. 263

Business Environment

Notes rate of growth of its economy. The Managing Director of International Monetary Fund Rodrigo

De Rato visited India in May 2005. In 2005, the IMF said that the budget of India is very positive

for it points that the economy of the country will grow at the rate of 6.7%.

International Monetary Fund said that the reasons behind the economy growth of India are that

the RBI has been able to control inflation and has also handled its monetary policies very

skillfully. The IMF has suggested that India can become a financial super power by bringing in

more reforms in its economic policies that will increase its growth rate to 8%.

The loans provided by IMF to India:

1. SDR 3,260,405,000 in 1992

2. SDR 3,584,905,000 in 1993

3. SDR 2,763,180,833 in 1994

4. SDR 1,966,633,125 in 1995

5. SDR 1,085,250,003 in 1996

6. SDR 589,791,667 in 1997

7. SDR 284,916,664 in 1998

8. SDR 38,500 in 1999

The Current Relationship between IMF and India

The relationship between the IMF and India has grown strong over the years. In fact, the country

has turned into a creditor to the IMF and has stopped taking loans from it. India and IMF must

continue to boost their relationship this way, as it will prove to be advantageous for both.

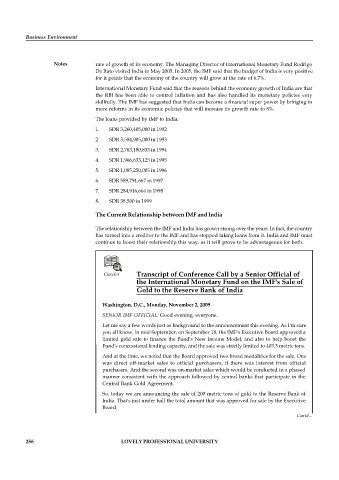

Caselet Transcript of Conference Call by a Senior Official of

the International Monetary Fund on the IMF's Sale of

Gold to the Reserve Bank of India

Washington, D.C., Monday, November 2, 2009

SENIOR IMF OFFICIAL: Good evening, everyone.

Let me say a few words just as background to the announcement this evening. As I'm sure

you all know, in mid-September, on September 18, the IMF's Executive Board approved a

limited gold sale to finance the Fund's New Income Model, and also to help boost the

Fund's concessional lending capacity, and the sale was strictly limited to 403.3 metric tons.

And at the time, we noted that the Board approved two broad modalities for the sale. One

was direct off-market sales to official purchasers, if there was interest from official

purchasers. And the second was on-market sales which would be conducted in a phased

manner consistent with the approach followed by central banks that participate in the

Central Bank Gold Agreement.

So, today we are announcing the sale of 200 metric tons of gold to the Reserve Bank of

India. That's just under half the total amount that was approved for sale by the Executive

Board.

Contd...

256 LOVELY PROFESSIONAL UNIVERSITY