Page 215 - DCOM106_COMPANY_LAW

P. 215

Company Law

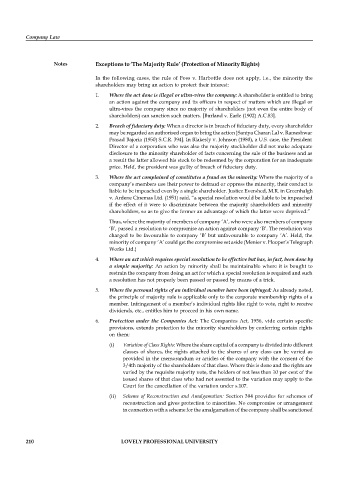

Notes Exceptions to ‘The Majority Rule’ (Protection of Minority Rights)

In the following cases, the rule of Foss v. Harbottle does not apply, i.e., the minority the

shareholders may bring an action to protect their interest:

1. Where the act done is illegal or ultra-vires the company: A shareholder is entitled to bring

an action against the company and its officers in respect of matters which are illegal or

ultra-vires the company since no majority of shareholders (not even the entire body of

shareholders) can sanction such matters. [Burland v. Earle (1902) A.C.83].

2. Breach of fiduciary duty: When a director is in breach of fiduciary duty, every shareholder

may be regarded an authorised organ to bring the action [Santya Charan Lal v. Rameshwar

Prasad Bajoria (1950) S.C.R. 394]. In Blakesly v. Johnson (1980), a U.S. case, the President

Director of a corporation who was also the majority stockholder did not make adequate

disclosure to the minority shareholder of facts concerning the sale of the business and as

a result the latter allowed his stock to be redeemed by the corporation for an inadequate

price. Held, the president was guilty of breach of fiduciary duty.

3. Where the act complained of constitutes a fraud on the minority: Where the majority of a

company’s members use their power to defraud or oppress the minority, their conduct is

liable to be impeached even by a single shareholder. Justice Evershed, M.R. in Greenhalgh

v. Ardene Cinemas Ltd. (1951) said, “a special resolution would be liable to be impeached

if the effect of it were to discriminate between the majority shareholders and minority

shareholders, so as to give the former an advantage of which the latter were deprived.”

Thus, where the majority of members of company ‘A’, who were also members of company

‘B’, passed a resolution to compromise an action against company ‘B’. The resolution was

charged to be favourable to company ‘B’ but unfavourable to company ‘A’. Held, the

minority of company ‘A’ could get the compromise set aside (Menier v. Hooper’s Telegraph

Works Ltd.)

4. Where an act which requires special resolution to be effective but has, in fact, been done by

a simple majority: An action by minority shall be maintainable where it is bought to

restrain the company from doing an act for which a special resolution is required and such

a resolution has not properly been passed or passed by means of a trick.

5. Where the personal rights of an individual member have been infringed: As already noted,

the principle of majority rule is applicable only to the corporate membership rights of a

member. Infringement of a member’s individual rights like right to vote, right to receive

dividends, etc., entitles him to proceed in his own name.

6. Protection under the Companies Act: The Companies Act, 1956, vide certain specific

provisions, extends protection to the minority shareholders by conferring certain rights

on them:

(i) Variation of Class Rights: Where the share capital of a company is divided into different

classes of shares, the rights attached to the shares of any class can be varied as

provided in the memorandum or articles of the company with the consent of the

3/4th majority of the shareholders of that class. Where this is done and the rights are

varied by the requisite majority vote, the holders of not less than 10 per cent of the

issued shares of that class who had not assented to the variation may apply to the

Court for the cancellation of the variation under s.107.

(ii) Scheme of Reconstruction and Amalgamation: Section 394 provides for schemes of

reconstruction and gives protection to minorities. No compromise or arrangement

in connection with a scheme for the amalgamation of the company shall be sanctioned

210 LOVELY PROFESSIONAL UNIVERSITY