Page 223 - DCOM106_COMPANY_LAW

P. 223

Company Law

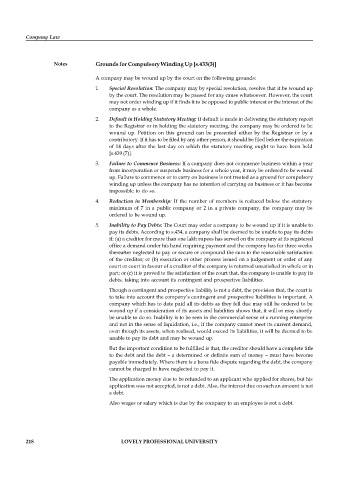

Notes Grounds for Compulsory Winding Up [s.433(3)]

A company may be wound up by the court on the following grounds:

1. Special Resolution: The company may by special resolution, resolve that it be wound up

by the court. The resolution may be passed for any cause whatsoever. However, the court

may not order winding up if it finds it to be opposed to public interest or the interest of the

company as a whole.

2. Default in Holding Statutory Meeting: If default is made in delivering the statutory report

to the Registrar or in holding the statutory meeting, the company may be ordered to be

wound up. Petition on this ground can be presented either by the Registrar or by a

contributory. If it has to be filed by any other person, it should be filed before the expiration

of 14 days after the last day on which the statutory meeting ought to have been held

[s.439 (7)].

3. Failure to Commence Business: If a company does not commence business within a year

from incorporation or suspends business for a whole year, it may be ordered to be wound

up. Failure to commence or to carry on business is not treated as a ground for compulsory

winding up unless the company has no intention of carrying on business or it has become

impossible to do so.

4. Reduction in Membership: If the number of members is reduced below the statutory

minimum of 7 in a public company or 2 in a private company, the company may be

ordered to be wound up.

5. Inability to Pay Debts: The Court may order a company to be wound up if it is unable to

pay its debts. According to s.434, a company shall be deemed to be unable to pay its debts

if: (a) a creditor for more than one lakh rupees has served on the company at its registered

office a demand under his hand requiring payment and the company has for three weeks

thereafter neglected to pay or secure or compound the sum to the reasonable satisfaction

of the creditor; or (b) execution or other process issued on a judgement or order of any

court or court in favour of a creditor of the company is returned unsatisfied in whole or in

part; or (c) it is proved to the satisfaction of the court that, the company is unable to pay its

debts, taking into account its contingent and prospective liabilities.

Though a contingent and prospective liability is not a debt, the provision that, the court is

to take into account the company’s contingent and prospective liabilities is important. A

company which has to date paid all its debts as they fell due may still be ordered to be

wound up if a consideration of its assets and liabilities shows that, it will or may shortly

be unable to do so. Inability is to be seen in the commercial sense of a running enterprise

and not in the sense of liquidation, i.e., if the company cannot meet its current demand,

even though its assets, when realised, would exceed its liabilities, it will be deemed to be

unable to pay its debt and may be wound up.

But the important condition to be fulfilled is that, the creditor should have a complete title

to the debt and the debt – a determined or definite sum of money – must have become

payable immediately. Where there is a bona fide dispute regarding the debt, the company

cannot be charged to have neglected to pay it.

The application money due to be refunded to an applicant who applied for shares, but his

application was not accepted, is not a debt. Also, the interest due on such an amount is not

a debt.

Also wages or salary which is due by the company to an employee is not a debt.

218 LOVELY PROFESSIONAL UNIVERSITY