Page 200 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 200

Unit 8: Methods of Redemption–I

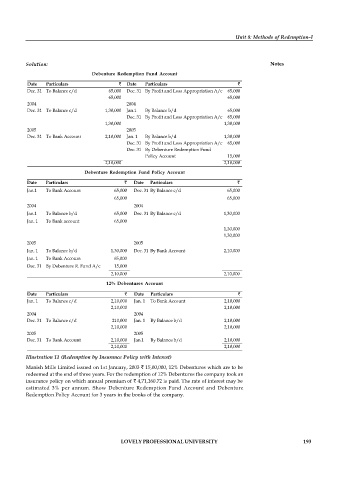

Solution: Notes

Debenture Redemption Fund Account

Date Particulars Date Particulars

Dec. 31 To Balance c/d 65,000 Dec. 31 By Profit and Loss Appropriation A/c 65,000

65,000 65,000

2004 2004

Dec. 31 To Balance c/d 1,30,000 Jan.1 By Balance b/d 65,000

Dec. 31 By Profit and Loss Appropriation A/c 65,000

1,30,000 1,30,000

2005 2005

Dec. 31 To Bank Account 2,10,000 Jan. 1 By Balance b/d 1,30,000

Dec. 31 By Profit and Loss Appropriation A/c 65,000

Dec. 31 By Debenture Redemption Fund

Policy Account 15,000

2,10,000 2,10,000

Debenture Redemption Fund Policy Account

Date Particulars Date Particulars

Jan.1 To Bank Account 65,000 Dec. 31 By Balance c/d 65,000

65,000 65,000

2004 2004

Jan.1 To Balance b/d 65,000 Dec. 31 By Balance c/d 1,30,000

Jan. 1 To Bank account 65,000

1,30,000

1,30,000

2005 2005

Jan. 1 To Balance b/d 1,30,000 Dec. 31 By Bank Account 2,10,000

Jan. 1 To Bank Account 65,000

Dec. 31 By Debenture R. Fund A/c 15,000

2,10,000 2,10,000

12% Debentures Account

Date Particulars Date Particulars

Jan. 1 To Balance c/d 2,10,000 Jan. 1 To Bank Account 2,10,000

2,10,000 2,10,000

2004 2004

Dec. 31 To Balance c/d 210,000 Jan. 1 By Balance b/d 2,10,000

2,10,000 2,10,000

2005 2005

Dec. 31 To Bank Account 2,10,000 Jan.1 By Balance b/d 2,10,000

2,10,000 2,10,000

Illustration 11 (Redemption by Insurance Policy with Interest)

Manish Mills Limited issued on 1st January, 2003 15,00,000, 12% Debentures which are to be

redeemed at the end of three years. For the redemption of 12% Debentures the company took an

insurance policy on which annual premium of 4,71,160.72 is paid. The rate of interest may be

estimated 3% per annum. Show Debenture Redemption Fund Account and Debenture

Redemption Policy Account for 3 years in the books of the company.

LOVELY PROFESSIONAL UNIVERSITY 193