Page 4 - DCOM202_COST_ACCOUNTING_I

P. 4

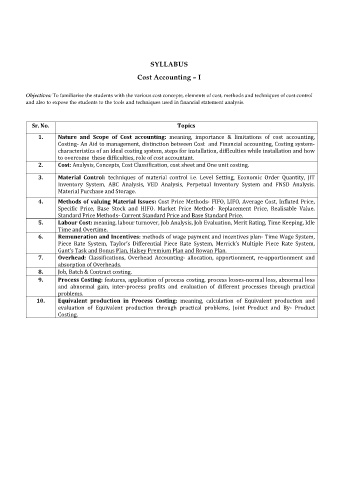

SYLLABUS

Cost Accounting – I

Objectives: To familiarise the students with the various cost concepts, elements of cost, methods and techniques of cost control

and also to expose the students to the tools and techniques used in financial statement analysis.

Sr. No. Topics

1. Nature and Scope of Cost accounting: meaning, importance & limitations of cost accounting,

Costing- An Aid to management, distinction between Cost and Financial accounting, Costing system-

characteristics of an ideal costing system, steps for installation, difficulties while installation and how

to overcome these difficulties, role of cost accountant.

2. Cost: Analysis, Concepts, Cost Classification, cost sheet and One unit costing.

3. Material Control: techniques of material control i.e. Level Setting, Economic Order Quantity, JIT

Inventory System, ABC Analysis, VED Analysis, Perpetual Inventory System and FNSD Analysis.

Material Purchase and Storage.

4. Methods of valuing Material Issues: Cost Price Methods- FIFO, LIFO, Average Cost, Inflated Price,

Specific Price, Base Stock and HIFO. Market Price Method- Replacement Price, Realisable Value.

Standard Price Methods- Current Standard Price and Base Standard Price.

5. Labour Cost: meaning, labour turnover, Job Analysis, Job Evaluation, Merit Rating, Time Keeping, Idle

Time and Overtime.

6. Remuneration and Incentives: methods of wage payment and incentives plan- Time Wage System,

Piece Rate System, Taylor’s Differential Piece Rate System, Merrick’s Multiple Piece Rate System,

Gant’s Task and Bonus Plan, Halsey Premium Plan and Rowan Plan.

7. Overhead: Classifications, Overhead Accounting- allocation, apportionment, re-apportionment and

absorption of Overheads.

8. Job, Batch & Contract costing.

9. Process Costing: features, application of process costing, process losses-normal loss, abnormal loss

and abnormal gain, inter-process profits and evaluation of different processes through practical

problems.

10. Equivalent production in Process Costing: meaning, calculation of Equivalent production and

evaluation of Equivalent production through practical problems, Joint Product and By- Product

Costing.