Page 167 - DCOM206_COST_ACCOUNTING_II

P. 167

Cost Accounting – II

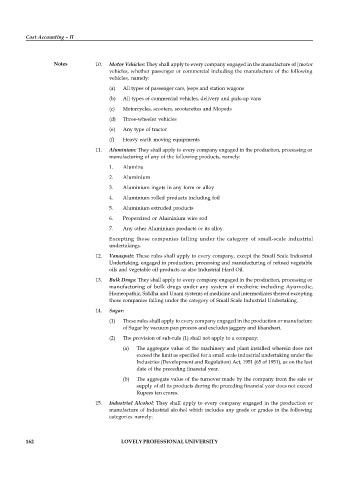

Notes 10. Motor Vehicles: They shall apply to every company engaged in the manufacture of [motor

vehicles, whether passenger or commercial including the manufacture of the following

vehicles, namely:

(a) All types of passenger cars, jeeps and station wagons

(b) All types of commercial vehicles, delivery and pick-up vans

(c) Motorcycles, scooters, scooterettes and Mopeds

(d) Three-wheeler vehicles

(e) Any type of tractor

(f) Heavy earth moving equipments

11. Aluminium: They shall apply to every company engaged in the production, processing or

manufacturing of any of the following products, namely:

1. Alumina

2. Aluminium

3. Aluminium ingots in any form or alloy

4. Aluminium rolled products including foil

5. Aluminium extruded products

6. Properzirod or Aluminium wire rod

7. Any other Aluminium products or its alloy.

Excepting those companies falling under the category of small-scale industrial

undertakings.

12. Vanaspati: These rules shall apply to every company, except the Small Scale Industrial

Undertaking, engaged in production, processing and manufacturing of refined vegetable

oils and vegetable oil products as also Industrial Hard Oil.

13. Bulk Drugs: They shall apply to every company engaged in the production, processing or

manufacturing of bulk drugs under any system of medicine including Ayurvedic,

Homeopathic, Siddha and Unani systems of medicine and intermediates thereof excepting

those companies falling under the category of Small Scale Industrial Undertaking.

14. Sugar:

(1) These rules shall apply to every company engaged in the production or manufacture

of Sugar by vacuum pan process and excludes jaggery and khandsari.

(2) The provision of sub-rule (1) shall not apply to a company:

(a) The aggregate value of the machinery and plant installed wherein does not

exceed the limit as specified for a small scale industrial undertaking under the

Industries (Development and Regulation) Act, 1951 (65 of 1951), as on the last

date of the preceding financial year.

(b) The aggregate value of the turnover made by the company from the sale or

supply of all its products during the preceding financial year does not exceed

Rupees ten crores.

15. Industrial Alcohol: They shall apply to every company engaged in the production or

manufacture of Industrial alcohol which includes any grade or grades in the following

categories namely:

162 LOVELY PROFESSIONAL UNIVERSITY