Page 264 - DCOM206_COST_ACCOUNTING_II

P. 264

Unit 14: Emerging Concepts in Cost Management

Three useful strategic frameworks for value chain analysis are: Notes

Industry structure analysis

Core competencies

Segmentation analysis

14.4.1 Industry Structure Analysis

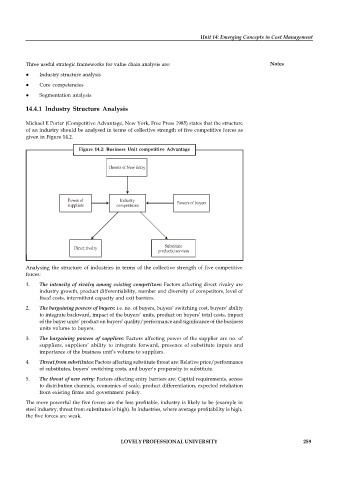

Michael E Porter (Competitive Advantage, New York, Free Press 1985) states that the structure

of an industry should be analysed in terms of collective strength of five competitive forces as

given in Figure 14.2.

Figure 14.2: Business Unit competitive Advantage

Analysing the structure of industries in terms of the collective strength of five competitive

forces:

1. The intensity of rivalry among existing competitors: Factors affecting direct rivalry are

industry growth, product differentiability, number and diversity of competitors, level of

fixed costs, intermittent capacity and exit barriers.

2. The bargaining powers of buyers: i.e. no. of buyers, buyers’ switching cost, buyers’ ability

to integrate backward, impact of the buyers’ units, product on buyers’ total costs, impact

of the buyer units’ product on buyers’ quality/performance and significance of the business

units volume to buyers.

3. The bargaining powers of suppliers: Factors affecting power of the supplier are no. of

suppliers, suppliers’ ability to integrate forward, presence of substitute inputs and

importance of the business unit’s volume to suppliers.

4. Threat from substitutes: Factors affecting substitute threat are: Relative price/performance

of substitutes, buyers’ switching costs, and buyer’s propensity to substitute.

5. The threat of new entry: Factors affecting entry barriers are: Capital requirements, access

to distribution channels, economies of scale, product differentiation, expected retaliation

from existing firms and government policy.

The more powerful the five forces are the less profitable, industry is likely to be (example in

steel industry, threat from substitutes is high). In industries, where average profitability is high,

the five forces are weak.

LOVELY PROFESSIONAL UNIVERSITY 259