Page 183 - DCOM208_BANKING_THEORY_AND_PRACTICE

P. 183

Banking Theory and Practice

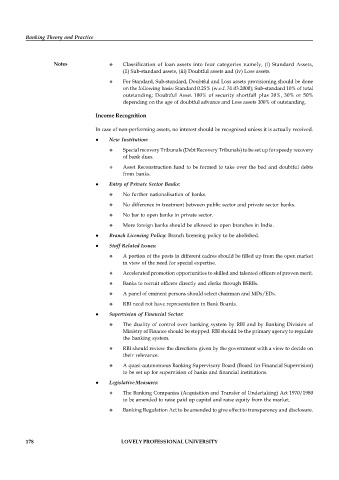

Notes Classification of loan assets into four categories namely, (i) Standard Assets,

(ii) Sub-standard assets, (iii) Doubtful assets and (iv) Loss assets.

For Standard, Sub-standard, Doubtful and Loss assets provisioning should be done

on the following basis: Standard 0.25% (w.e.f. 31.03.2000); Sub-standard 10% of total

outstanding; Doubtful Asset 100% of security shortfall plus 20%, 30% or 50%

depending on the age of doubtful advance and Loss assets 100% of outstanding.

Income Recognition

In case of non-performing assets, no interest should be recognised unless it is actually received.

New Institution:

Special recovery Tribunals (Debt Recovery Tribunals) to be set up for speedy recovery

of bank dues.

Asset Reconstruction fund to be formed to take over the bad and doubtful debts

from banks.

Entry of Private Sector Banks:

No further nationalisation of banks.

No difference in treatment between public sector and private sector banks.

No bar to open banks in private sector.

More foreign banks should be allowed to open branches in India.

Branch Licensing Policy: Branch licensing policy to be abolished.

Staff Related Issues:

A portion of the posts in different cadres should be filled up from the open market

in view of the need for special expertise.

Accelerated promotion opportunities to skilled and talented officers of proven merit.

Banks to recruit officers directly and clerks through BSRBs.

A panel of eminent persons should select chairman and MDs/EDs.

RBI need not have representation in Bank Boards.

Supervision of Financial Sector:

The duality of control over banking system by RBI and by Banking Division of

Ministry of Finance should be stopped. RBI should be the primary agency to regulate

the banking system.

RBI should review the directions given by the government with a view to decide on

their relevance.

A quasi-autonomous Banking Supervisory Board (Board for Financial Supervision)

to be set up for supervision of banks and financial institutions.

Legislative Measures:

The Banking Companies (Acquisition and Transfer of Undertaking) Act 1970/1980

to be amended to raise paid up capital and raise equity from the market.

Banking Regulation Act to be amended to give effect to transparency and disclosure.

178 LOVELY PROFESSIONAL UNIVERSITY