Page 15 - DCOM301_INCOME_TAX_LAWS_I

P. 15

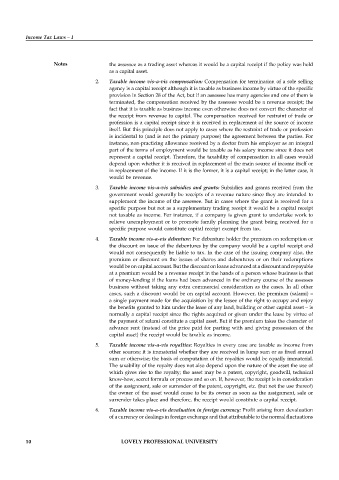

Income Tax Laws – I

Notes the assessee as a trading asset whereas it would be a capital receipt if the policy was held

as a capital asset.

2. Taxable income vis-a-vis compensation: Compensation for termination of a sole selling

agency is a capital receipt although it is taxable as business income by virtue of the specific

provision in Section 28 of the Act, but if an assessee has many agencies and one of them is

terminated, the compensation received by the assessee would be a revenue receipt; the

fact that it is taxable as business income even otherwise does not convert the character of

the receipt from revenue to capital. The compensation received for restraint of trade or

profession is a capital receipt since it is received in replacement of the source of income

itself. But this principle does not apply to cases where the restraint of trade or profession

is incidental to (and is not the primary purpose) the agreement between the parties. For

instance, non-practicing allowance received by a doctor from his employer as an integral

part of the terms of employment would be taxable as his salary income since it does not

represent a capital receipt. Therefore, the taxability of compensation in all cases would

depend upon whether it is received in replacement of the main source of income itself or

in replacement of the income. If it is the former, it is a capital receipt; in the latter case, it

would be revenue.

3. Taxable income vis-a-vis subsidies and grants: Subsidies and grants received from the

government would generally be receipts of a revenue nature since they are intended to

supplement the income of the assessee. But in cases where the grant is received for a

specific purpose but not as a supplementary trading receipt it would be a capital receipt

not taxable as income. For instance, if a company is given grant to undertake work to

relieve unemployment or to promote family planning the grant being received for a

specific purpose would constitute capital receipt exempt from tax.

4. Taxable income vis-a-vis debenture: For debenture holder the premium on redemption or

the discount on issue of the debentures by the company would be a capital receipt and

would not consequently be liable to tax. In the case of the issuing company also, the

premium or discount on the issues of shares and debentures or on their redemptions

would be on capital account. But the discount on loans advanced at a discount and repayable

at a premium would be a revenue receipt in the hands of a person whose business is that

of money-lending if the loans had been advanced in the ordinary course of the assesses

business without taking any extra commercial consideration as the cases. In all other

cases, such a discount would be on capital account. However, the premium (salami) –

a single payment made for the acquisition by the lessee of the right to occupy and enjoy

the benefits granted to him under the lease of any land, building or other capital asset – is

normally a capital receipt since the rights acquired or given under the lease by virtue of

the payment of salami constitute a capital asset. But if the premium takes the character of

advance rent (instead of the price paid for parting with and giving possession of the

capital asset) the receipt would be taxable as income.

5. Taxable income vis-a-vis royalties: Royalties in every case are taxable as income from

other sources; it is immaterial whether they are received in lump sum or as fixed annual

sum or otherwise; the basis of computation of the royalties would be equally immaterial.

The taxability of the royalty does not also depend upon the nature of the asset the use of

which gives rise to the royalty; the asset may be a patent, copyright, goodwill, technical

know-how, secret formula or process and so on. If, however, the receipt is in consideration

of the assignment, sale or surrender of the patent, copyright, etc. (but not the use thereof)

the owner of the asset would cease to be its owner as soon as the assignment, sale or

surrender takes place and therefore, the receipt would constitute a capital receipt.

6. Taxable income vis-a-vis devaluation in foreign currency: Profit arising from devaluation

of a currency or dealings in foreign exchange and that attributable to the normal fluctuations

10 LOVELY PROFESSIONAL UNIVERSITY