Page 165 - DCOM301_INCOME_TAX_LAWS_I

P. 165

Income Tax Laws – I

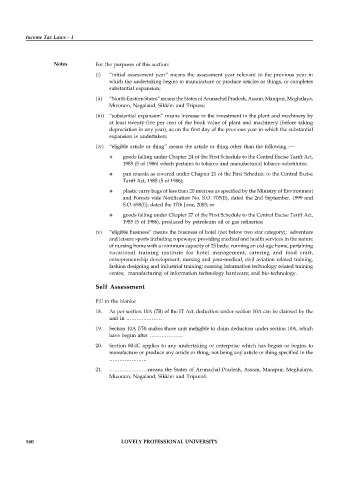

Notes For the purposes of this section:

(i) “initial assessment year” means the assessment year relevant to the previous year in

which the undertaking begins to manufacture or produce articles or things, or completes

substantial expansion;

(ii) “North-Eastern States” means the States of Arunachal Pradesh, Assam, Manipur, Meghalaya,

Mizoram, Nagaland, Sikkim and Tripura;

(iii) “substantial expansion” means increase in the investment in the plant and machinery by

at least twenty-five per cent of the book value of plant and machinery (before taking

depreciation in any year), as on the first day of the previous year in which the substantial

expansion is undertaken;

(iv) “eligible article or thing” means the article or thing other than the following :—

goods falling under Chapter 24 of the First Schedule to the Central Excise Tariff Act,

1985 (5 of 1986) which pertains to tobacco and manufactured tobacco substitutes;

pan masala as covered under Chapter 21 of the First Schedule to the Central Excise

Tariff Act, 1985 (5 of 1986);

plastic carry bags of less than 20 microns as specified by the Ministry of Environment

and Forests vide Notification No. S.O. 705(E), dated the 2nd September, 1999 and

S.O. 698(E), dated the 17th June, 2003; or

goods falling under Chapter 27 of the First Schedule to the Central Excise Tariff Act,

1985 (5 of 1986), produced by petroleum oil or gas refineries;

(v) “eligible business” means the business of hotel (not below two star category); adventure

and leisure sports including ropeways; providing medical and health services in the nature

of nursing home with a minimum capacity of 25 beds; running an old-age home, pertaining

vocational training institute for hotel management, catering and food craft,

entrepreneurship development, nursing and para-medical, civil aviation related training,

fashion designing and industrial training; running information technology related training

centre; manufacturing of information technology hardware; and bio-technology.

Self Assessment

Fill in the blanks:

18. As per section 10A (7B) of the IT Act, deduction under section 10A can be claimed by the

unit in …………………

19. Section 10A (7B) makes those unit ineligible to claim deduction under section 10A, which

have begun after ………………..

20. Section 80-IC applies to any undertaking or enterprise which has begun or begins to

manufacture or produce any article or thing, not being any article or thing specified in the

………………….

21. …………………..means the States of Arunachal Pradesh, Assam, Manipur, Meghalaya,

Mizoram, Nagaland, Sikkim and Tripura1.

160 LOVELY PROFESSIONAL UNIVERSITY