Page 23 - DCOM301_INCOME_TAX_LAWS_I

P. 23

Income Tax Laws – I

Notes (viii) Artificial Persons: This category could cover every artificial juridical person not falling

under other heads. An idol or deity would be assessable in the status of an artificial

juridical person.

(3) Income [Section 2(24)]: Section 2(24) of the Act gives a statutory definition of income. This

definition is inclusive and not exhaustive. Thus, it gives scope to include more items in the

definition of income as circumstances may warrant. At present, the following items of

re-ceipts are included in income:

Profits and gains.

Dividends.

Voluntary contributions received by a trust/institution created wholly or partly for

charitable or religious purposes or by an association or institution referred to in

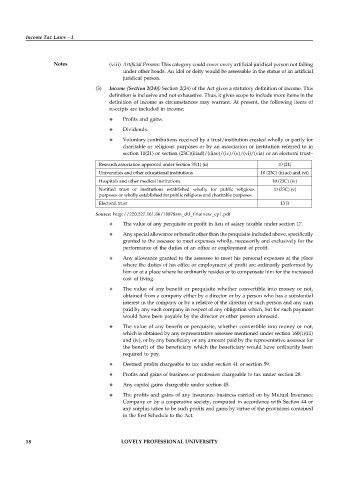

section 10(21) or section (23C)(iiiad)/(iiiae)/(iv)/(v)/(vi)/(via) or an electoral trust–

Research association approved under Section 35(1) (ii) 10 (21)

Universities and other educational institutions 10 (23C) (iii ad) and (vi)

Hospitals and other medical institutions 10 (23C) (iv)

Notified trust or institutions established wholly for public religious 10 (23C) (v)

purposes or wholly established for public religious and charitable purposes

Electoral trust 13 B

Source: http://220.227.161.86/18878sm_dtl_finalnew_cp1.pdf

The value of any perquisite or profit in lieu of salary taxable under section 17.

Any special allowance or benefit other than the perquisite included above, specifically

granted to the assessee to meet expenses wholly, necessarily and exclusively for the

performance of the duties of an office or employment of profit.

Any allowance granted to the assessee to meet his personal expenses at the place

where the duties of his office or employment of profit are ordinarily performed by

him or at a place where he ordinarily resides or to compensate him for the increased

cost of living.

The value of any benefit or perquisite whether convertible into money or not,

obtained from a company either by a director or by a person who has a substantial

interest in the company or by a relative of the director or such person and any sum

paid by any such company in respect of any obligation which, but for such payment

would have been payable by the director or other person aforesaid.

The value of any benefit or perquisite, whether convertible into money or not,

which is obtained by any representative assessee mentioned under section 160(1)(iii)

and (iv), or by any beneficiary or any amount paid by the representative assessee for

the benefit of the beneficiary which the beneficiary would have ordinarily been

required to pay.

Deemed profits chargeable to tax under section 41 or section 59.

Profits and gains of business or profession chargeable to tax under section 28.

Any capital gains chargeable under section 45.

The profits and gains of any insurance business carried on by Mutual Insurance

Company or by a cooperative society, computed in accordance with Section 44 or

any surplus taken to be such profits and gains by virtue of the provisions contained

in the first Schedule to the Act.

18 LOVELY PROFESSIONAL UNIVERSITY