Page 235 - DCOM301_INCOME_TAX_LAWS_I

P. 235

Income Tax Laws – I

Notes For the purpose of determining the Annual value, the actual rent shall not include the rent which

cannot be realized by the owner. However, the following conditions need to be satisfied for this:

1. The tenancy is bona fide;

2. The defaulting tenant has vacated, or steps have been taken to compel him to vacate the

property.

3. The defaulting tenant is not in occupation of any other property of the assessee;

4. The assessee has taken all reasonable steps to institute legal proceedings for the recovery

of the unpaid rent or satisfied the Assessing Officer that legal proceedings would be

useless.

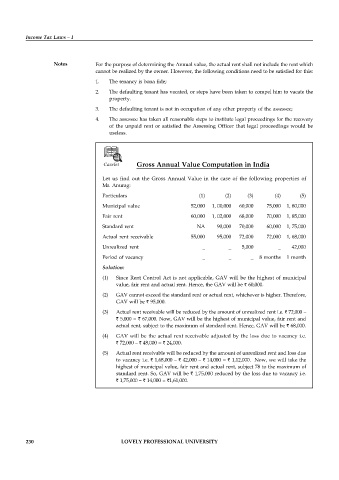

Caselet Gross Annual Value Computation in India

Let us find out the Gross Annual Value in the case of the following properties of

Mr. Anurag:

Particulars (1) (2) (3) (4) (5)

Municipal value 52,000 1, 00,000 60,000 75,000 1, 80,000

Fair rent 60,000 1, 02,000 68,000 70,000 1, 85,000

Standard rent NA 90,000 70,000 60,000 1, 75,000

Actual rent receivable 55,000 95,000 72,000 72,000 1, 68,000

Unrealized rent _ _ 5,000 _ 42,000

Period of vacancy _ _ _ 8 months 1 month

Solution:

(1) Since Rent Control Act is not applicable, GAV will be the highest of municipal

value, fair rent and actual rent. Hence, the GAV will be ` 60,000.

(2) GAV cannot exceed the standard rent or actual rent, whichever is higher. Therefore,

GAV will be ` 95,000.

(3) Actual rent receivable will be reduced by the amount of unrealized rent i.e. ` 72,000 –

` 5,000 = ` 67,000. Now, GAV will be the highest of municipal value, fair rent and

actual rent, subject to the maximum of standard rent. Hence, GAV will be ` 68,000.

(4) GAV will be the actual rent receivable adjusted by the loss due to vacancy i.e.

` 72,000 – ` 48,000 = ` 24,000.

(5) Actual rent receivable will be reduced by the amount of unrealized rent and loss due

to vacancy i.e. ` 1,68,000 – ` 42,000 – ` 14,000 = ` 1,12,000. Now, we will take the

highest of municipal value, fair rent and actual rent, subject 78 to the maximum of

standard rent. So, GAV will be ` 1,75,000 reduced by the loss due to vacancy i.e.

` 1,75,000 – ` 14,000 = `1,61,000.

230 LOVELY PROFESSIONAL UNIVERSITY