Page 282 - DCOM301_INCOME_TAX_LAWS_I

P. 282

Unit 9: Income under the Head Business and Profession

Solution: Notes

1. Assuming that the termination of the services of an employee was in the interest of the

business, this item will be treated as an admissible expenditure.

2. It is admissible as the expenditure has been incurred to maintain an asset (viz., the

trademark).

3. Penalty paid for illegal activities of the assessee are not to be allowed as expenditure

under the Income Tax Act.

4. It is inadmissible as it is incurred for the acquisition of a new asset.

5. It is not an admissible expenditure, being of a capital nature. However, depreciation can

be claimed u/s 32(1).

6. On the cost of know-how depreciation shall be allowed @ 25% on W.D.V. basis u/s 32(1).

7. This loss is admissible as it was part of his duty to carry cash for depositing it in bank and

hence it is incidental to the business.

8. It is admissible as it has been sustained during the ordinary course of business.

9. Brokerage paid for raising a loan for the business is an admissible expenditure.

10. It is an admissible deduction under executive instruction.

11. It is not admissible as it is in the nature of capital expenditure, but 1/5th of it will be

allowed under Section 35D for five successive previous years.

12. Pension paid to the widow and children of a deceased engineer is not allowed as deduction

as it is not an obligatory expenditure in connection with the business.

13. Interest paid for funds borrowed specifically for the acquisition of a capital asset is allowable

u/s 36(1)(iii) as it is incurred for the purpose of the business.

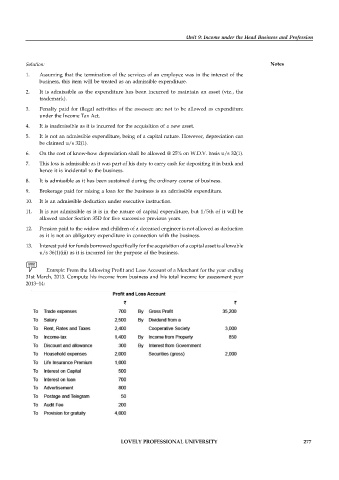

Example: From the following Profit and Loss Account of a Merchant for the year ending

31st March, 2013. Compute his income from business and his total income for assessment year

2013–14:

LOVELY PROFESSIONAL UNIVERSITY 277