Page 398 - DCOM301_INCOME_TAX_LAWS_I

P. 398

Unit 14: Advance Tax Planning and Tax Relief

Notes

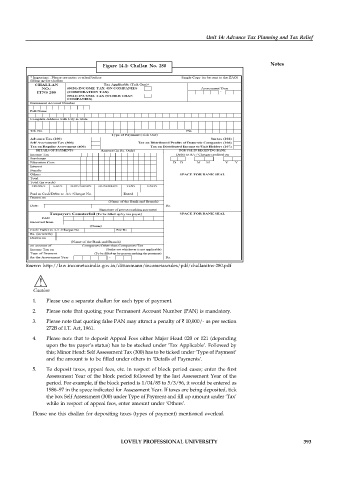

Figure 14.1: Challan No. 280

Source: http://law.incometaxindia.gov.in/dittaxmann/incometaxrules/pdf/challanitns-280.pdf

!

Caution

1. Please use a separate challan for each type of payment.

2. Please note that quoting your Permanent Account Number (PAN) is mandatory.

3. Please note that quoting false PAN may attract a penalty of ` 10,000/- as per section

272B of I.T. Act, 1961.

4. Please note that to deposit Appeal Fees either Major Head 020 or 021 (depending

upon the tax payer’s status) has to be stocked under ‘Tax Applicable’. Followed by

this; Minor Head: Self Assessment Tax (300) has to be ticked under ‘Type of Payment’

and the amount is to be filled under others in ‘Details of Payments’.

5. To deposit taxes, appeal fees, etc. in respect of block period cases; enter the first

Assessment Year of the block period followed by the last Assessment Year of the

period. For example, if the block period is 1/04/85 to 5/3/96, it would be entered as

1986–97 in the space indicated for Assessment Year. If taxes are being deposited, tick

the box Self Assessment (300) under Type of Payment and fill up amount under ‘Tax’

while in respect of appeal fees, enter amount under ‘Others’.

Please use this challan for depositing taxes (types of payment) mentioned overleaf.

LOVELY PROFESSIONAL UNIVERSITY 393