Page 67 - DCOM302_MANAGEMENT_ACCOUNTING

P. 67

Management Accounting

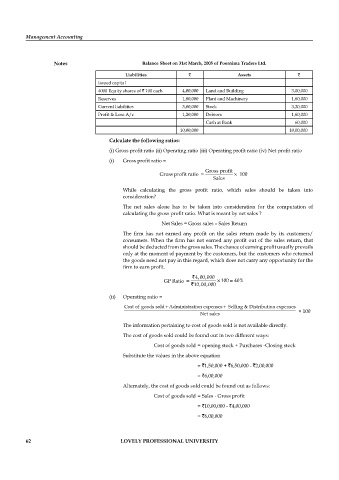

Notes Balance Sheet on 31st March, 2005 of Poornima Traders Ltd.

Liabilities ` Assets `

Issued capital

4000 Equity shares of ` 100 each 4,00,000 Land and Building 3,00,000

Reserves 1,80,000 Plant and Machinery 1,60,000

Current liabilities 3,00,000 Stock 3,20,000

Profit & Loss A/c 1,20,000 Debtors 1,60,000

Cash at Bank 60,000

10,00,000 10,00,000

Calculate the following ratios:

(i) Gross profit ratio (ii) Operating ratio (iii) Operating profit ratio (iv) Net profi t ratio

(i) Gross profit ratio =

Gross profi t ratio = Gross profit × 100

Sales

While calculating the gross profit ratio, which sales should be taken into

consideration?

The net sales alone has to be taken into consideration for the computation of

calculating the gross profit ratio. What is meant by net sales ?

Net Sales = Gross sales – Sales Return

The firm has not earned any profit on the sales return made by its customers/

consumers. When the firm has not earned any profit out of the sales return, that

should be deducted from the gross sales. The chance of earning profit usually prevails

only at the moment of payment by the customers, but the customers who returned

the goods need not pay in this regard, which does not carry any opportunity for the

firm to earn profi t.

`400000

,

,

GP Ratio = × 100 = 40%

`10 00 000

,

,

(ii) Operating ratio =

+

+

Cost of goods sold Administration expenses Selling & Distribution expenses

r

× 100

Net sales

The information pertaining to cost of goods sold is not available directly.

The cost of goods sold could be found out in two different ways:

Cost of goods sold = opening stock + Purchases -Closing stock

Substitute the values in the above equation

= `1,50,000 + `6,50,000 - `2,00,000

= `6,00,000

Alternately, the cost of goods sold could be found out as follows:

Cost of goods sold = Sales - Gross profi t

= `10,00,000 - `4,00,000

= `6,00,000

62 LOVELY PROFESSIONAL UNIVERSITY