Page 89 - DCOM302_MANAGEMENT_ACCOUNTING

P. 89

Management Accounting

Notes 2. Proposed Dividend and Dividend Paid: Dividend paid during the year should be treated

as an application of fund, therefore, it must be shown in the fund flow statement. Proposed

dividend is not accumulated therefore, it should not be treated as a current liability. It is

assumed that the proposed dividend of the previous year is paid during the year whether

it is said or not. Therefore, it will be a use of fund. Proposed dividend and interim dividend

are the appropriations against profit. So to calculate the fund from operation it must be

added back to net profits like other appropriations. It must be noted that the closing balance

of the P & L account of a year should be equal to the opening balance of P & L A/c in the

next year. If there is any difference between these two figures, difference should be treated

as payment of dividend during the year.

3. Depreciation of the Assets: It is an item considered to be non-recurring expenditure. It was

considered at par with the other expenditures/expenses which do not reduce the volume

of working capital. The charge of depreciation never indulges in the payment of cash

resources from the fi rm.

Writing off Fictitious and Intangible Assets:

Fictitious Assets Intangible Assets

Preliminary expenses Goodwill

Discount on issue of shares/ debentures Patents

Trade Mark

The writing off of the above enlisted item of fi ctitious and intangible assets do not involve any

payments.

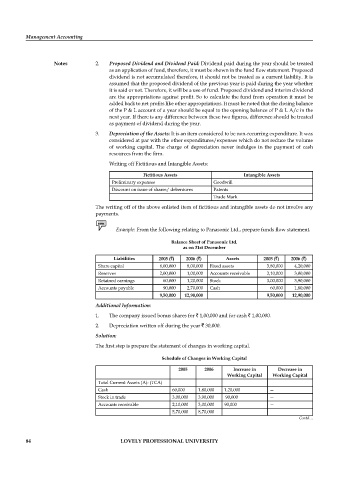

Example: From the following relating to Panasonic Ltd., prepare funds fl ow statement.

Balance Sheet of Panasonic Ltd.

as on 31st December

Liabilities 2005 (`) 2006 (`) Assets 2005 (`) 2006 (`)

Share capital 6,00,000 8,00,000 Fixed assets 3,80,000 4,20,000

Reserves 2,00,000 1,00,000 Accounts receivable 2,10,000 3,00,000

Retained earnings 60,000 1,20,000 Stock 3,00,000 3,90,000

Accounts payable 90,000 2,70,000 Cash 60,000 1,80,000

9,50,000 12,90,000 9,50,000 12,90,000

Additional Information:

1. The company issued bonus shares for ` 1,00,000 and for cash ` 1,00,000.

2. Depreciation written off during the year ` 30,000.

Solution:

The first step is prepare the statement of changes in working capital.

Schedule of Changes in Working Capital

2005 2006 Increase in Decrease in

Working Capital Working Capital

Total Current Assets (A): (TCA)

Cash 60,000 1,80,000 1,20,000 —

Stock in trade 3,00,000 3,90,000 90,000 —

Accounts receivable 2,10,000 3,00,000 90,000 —

5,70,000 8,70,000

Contd…

84 LOVELY PROFESSIONAL UNIVERSITY