Page 127 - DCOM304_INDIAN_FINANCIAL_SYSTEM

P. 127

Indian Financial System

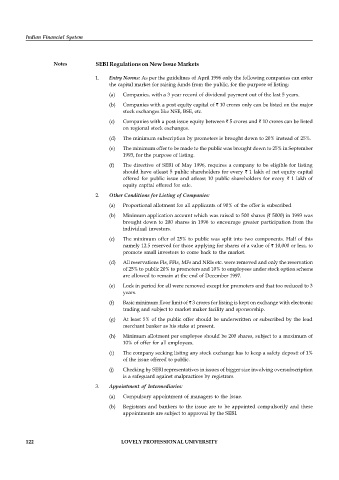

Notes SEBI Regulations on New Issue Markets

1. Entry Norms: As per the guidelines of April 1996 only the following companies can enter

the capital market for raising funds from the public, for the purpose of listing:

(a) Companies, with a 3 year record of dividend payment out of the last 5 years.

(b) Companies with a post equity capital of ` 10 crores only can be listed on the major

stock exchanges like NSE, BSE, etc.

(c) Companies with a post issue equity between ` 5 crores and ` 10 crores can be listed

on regional stock exchanges.

(d) The minimum subscription by promoters is brought down to 20% instead of 25%.

(e) The minimum offer to be made to the public was brought down to 25% in September

1993, for the purpose of listing.

(f) The directive of SEBI of May 1996, requires a company to be eligible for listing

should have atleast 5 public shareholders for every ` 1 lakh of net equity capital

offered for public issue and atleast 10 public shareholders for every ` 1 lakh of

equity capital offered for sale.

2. Other Conditions for Listing of Companies:

(a) Proportional allotment for all applicants of 90% of the offer is subscribed.

(b) Minimum application account which was raised to 500 shares (` 5000) in 1993 was

brought down to 200 shares in 1996 to encourage greater participation from the

individual investors.

(c) The minimum offer of 25% to public was split into two components. Half of this

namely 12.5 reserved for those applying for shares of a value of ` 10,000 or less, to

promote small investors to come back to the market.

(d) All reservations FIs, FFIs, MFs and NRIs etc. were removed and only the reservation

of 25% to public 20% to promoters and 10% to employees under stock option scheme

are allowed to remain at the end of December 1997.

(e) Lock in period for all were removed except for promoters and that too reduced to 3

years.

(f) Basic minimum floor limit of ` 3 crores for listing is kept on exchange with electronic

trading and subject to market maker facility and sponsorship.

(g) At least 5% of the public offer should be underwritten or subscribed by the lead

merchant banker as his stake at present.

(h) Minimum allotment per employee should be 200 shares, subject to a maximum of

10% of offer for all employees.

(i) The company seeking listing any stock exchange has to keep a safety deposit of 1%

of the issue offered to public.

(j) Checking by SEBI representatives in issues of bigger size involving oversubscription

is a safeguard against malpractices by registrars.

3. Appointment of Intermediaries:

(a) Compulsory appointment of managers to the issue.

(b) Registrars and bankers to the issue are to be appointed compulsorily and these

appointments are subject to approval by the SEBI.

122 LOVELY PROFESSIONAL UNIVERSITY