Page 96 - DCOM304_INDIAN_FINANCIAL_SYSTEM

P. 96

Unit 5: Primary Market

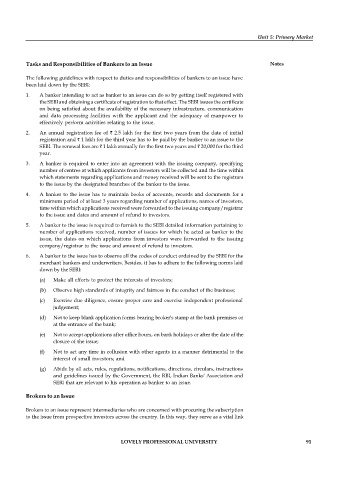

Tasks and Responsibilities of Bankers to an Issue Notes

The following guidelines with respect to duties and responsibilities of bankers to an issue have

been laid down by the SEBI:

1. A banker intending to act as banker to an issue can do so by getting itself registered with

the SEBI and obtaining a certificate of registration to that effect. The SEBI issues the certificate

on being satisfied about the availability of the necessary infrastructure, communication

and data processing facilities with the applicant and the adequacy of manpower to

effectively perform activities relating to the issue.

2. An annual registration fee of ` 2.5 lakh for the first two years from the date of initial

registration and ` 1 lakh for the third year has to be paid by the banker to an issue to the

SEBI. The renewal fees are ` 1 lakh annually for the first two years and ` 20,000 for the third

year.

3. A banker is required to enter into an agreement with the issuing company, specifying

number of centres at which applicants from investors will be collected and the time within

which statements regarding applications and money received will be sent to the registrars

to the issue by the designated branches of the banker to the issue.

4. A banker to the issue has to maintain books of accounts, records and documents for a

minimum period of at least 3 years regarding number of applications, names of investors,

time within which applications received were forwarded to the issuing company/registrar

to the issue and dates and amount of refund to investors.

5. A banker to the issue is required to furnish to the SEBI detailed information pertaining to

number of applications received, number of issues for which he acted as banker to the

issue, the dates on which applications from investors were forwarded to the issuing

company/registrar to the issue and amount of refund to investors.

6. A banker to the issue has to observe all the codes of conduct ordained by the SEBI for the

merchant bankers and underwriters. Besides, it has to adhere to the following norms laid

down by the SEBI:

(a) Make all efforts to protect the interests of investors;

(b) Observe high standards of integrity and fairness in the conduct of the business;

(c) Exercise due diligence, ensure proper care and exercise independent professional

judgement;

(d) Not to keep blank application forms bearing broker's stamp at the bank premises or

at the entrance of the bank;

(e) Not to accept applications after office hours, on bank holidays or after the date of the

closure of the issue;

(f) Not to act any time in collusion with other agents in a manner detrimental to the

interest of small investors; and

(g) Abide by all acts, rules, regulations, notifications, directions, circulars, instructions

and guidelines issued by the Government, the RBI, Indian Banks' Association and

SEBI that are relevant to his operation as banker to an issue.

Brokers to an Issue

Brokers to an issue represent intermediaries who are concerned with procuring the subscription

to the issue from prospective investors across the country. In this way, they serve as a vital link

LOVELY PROFESSIONAL UNIVERSITY 91