Page 19 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 19

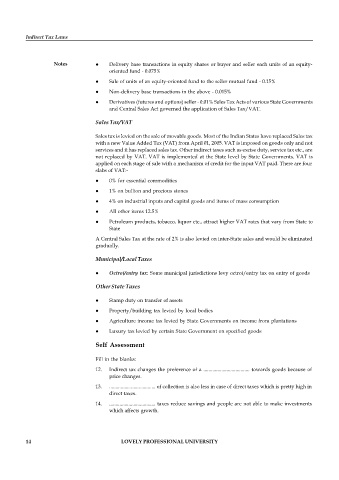

Indirect Tax Laws

Notes Delivery base transactions in equity shares or buyer and seller each units of an equity-

oriented fund - 0.075%

Sale of units of an equity-oriented fund to the seller mutual fund - 0.15%

Non-delivery base transactions in the above - 0.015%

Derivatives (futures and options) seller - 0.01% Sales Tax Acts of various State Governments

and Central Sales Act governed the application of Sales Tax/VAT.

Sales Tax/VAT

Sales tax is levied on the sale of movable goods. Most of the Indian States have replaced Sales tax

with a new Value Added Tax (VAT) from April 01, 2005. VAT is imposed on goods only and not

services and it has replaced sales tax. Other indirect taxes such as excise duty, service tax etc., are

not replaced by VAT. VAT is implemented at the State level by State Governments. VAT is

applied on each stage of sale with a mechanism of credit for the input VAT paid. There are four

slabs of VAT:-

0% for essential commodities

1% on bullion and precious stones

4% on industrial inputs and capital goods and items of mass consumption

All other items 12.5%

Petroleum products, tobacco, liquor etc., attract higher VAT rates that vary from State to

State

A Central Sales Tax at the rate of 2% is also levied on inter-State sales and would be eliminated

gradually.

Municipal/Local Taxes

Octroi/entry tax: Some municipal jurisdictions levy octroi/entry tax on entry of goods

Other State Taxes

Stamp duty on transfer of assets

Property/building tax levied by local bodies

Agriculture income tax levied by State Governments on income from plantations

Luxury tax levied by certain State Government on specified goods

Self Assessment

Fill in the blanks:

12. Indirect tax changes the preference of a .................................... towards goods because of

price changes.

13. .................................... of collection is also less in case of direct taxes which is pretty high in

direct taxes.

14. .................................... taxes reduce savings and people are not able to make investments

which affects growth.

14 LOVELY PROFESSIONAL UNIVERSITY