Page 56 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 56

Pooja, Lovely Professional University

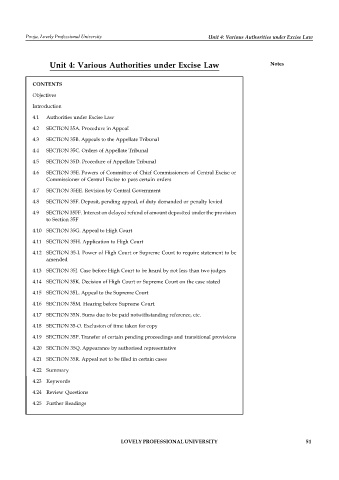

Unit 4: Various Authorities under Excise Law

Unit 4: Various Authorities under Excise Law Notes

CONTENTS

Objectives

Introduction

4.1 Authorities under Excise Law

4.2 SECTION 35A. Procedure in Appeal

4.3 SECTION 35B. Appeals to the Appellate Tribunal

4.4 SECTION 35C. Orders of Appellate Tribunal

4.5 SECTION 35D. Procedure of Appellate Tribunal

4.6 SECTION 35E. Powers of Committee of Chief Commissioners of Central Excise or

Commissioner of Central Excise to pass certain orders

4.7 SECTION 35EE. Revision by Central Government

4.8 SECTION 35F. Deposit, pending appeal, of duty demanded or penalty levied

4.9 SECTION 35FF. Interest on delayed refund of amount deposited under the provision

to Section 35F

4.10 SECTION 35G. Appeal to High Court

4.11 SECTION 35H. Application to High Court

4.12 SECTION 35-I. Power of High Court or Supreme Court to require statement to be

amended

4.13 SECTION 35J. Case before High Court to be heard by not less than two judges

4.14 SECTION 35K. Decision of High Court or Supreme Court on the case stated

4.15 SECTION 35L. Appeal to the Supreme Court

4.16 SECTION 35M. Hearing before Supreme Court.

4.17 SECTION 35N. Sums due to be paid notwithstanding reference, etc.

4.18 SECTION 35-O. Exclusion of time taken for copy

4.19 SECTION 35P. Transfer of certain pending proceedings and transitional provisions

4.20 SECTION 35Q. Appearance by authorised representative

4.21 SECTION 35R. Appeal not to be filed in certain cases

4.22 Summary

4.23 Keywords

4.24 Review Questions

4.25 Further Readings

LOVELY PROFESSIONAL UNIVERSITY 51