Page 157 - DECO303_INDIAN_ECONOMY_ENGLISH

P. 157

Indian Economy

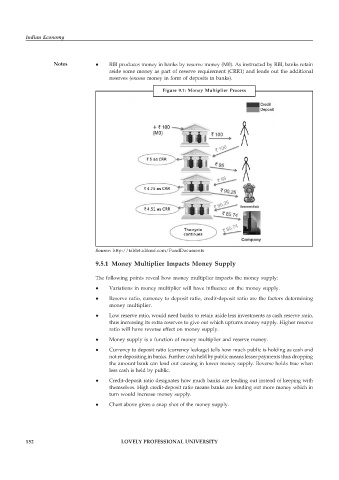

Notes RBI produces money in banks by reserve money (M0). As instructed by RBI, banks retain

aside some money as part of reserve requirement (CRR1) and lends out the additional

reserves (excess money in form of deposits in banks).

Figure 9.1: Money Multiplier Process

Source: http://tablet.idfcmf.com/FundDocuments

9.5.1 Money Multiplier Impacts Money Supply

The following points reveal how money multiplier impacts the money supply:

Variations in money multiplier will have influence on the money supply.

Reserve ratio, currency to deposit ratio, credit-deposit ratio are the factors determining

money multiplier.

Low reserve ratio, would need banks to retain aside less investments as cash reserve ratio,

thus increasing its extra reserves to give out which upturns money supply. Higher reserve

ratio will have reverse effect on money supply.

Money supply is a function of money multiplier and reserve money.

Currency to deposit ratio (currency leakage) tells how much public is holding as cash and

not re depositing in banks. Further cash held by public means lesser payments thus dropping

the amount bank can lend out causing in lower money supply. Reverse holds true when

less cash is held by public.

Credit-deposit ratio designates how much banks are lending out instead of keeping with

themselves. High credit-deposit ratio means banks are lending out more money which in

turn would increase money supply.

Chart above gives a snap shot of the money supply.

152 LOVELY PROFESSIONAL UNIVERSITY