Page 247 - DECO303_INDIAN_ECONOMY_ENGLISH

P. 247

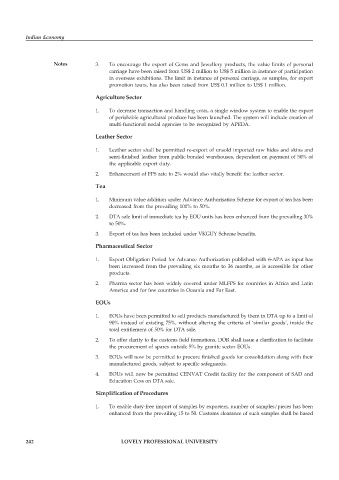

Indian Economy

Notes 3. To encourage the export of Gems and Jewellery products, the value limits of personal

carriage have been raised from US$ 2 million to US$ 5 million in instance of participation

in overseas exhibitions. The limit in instance of personal carriage, as samples, for export

promotion tours, has also been raised from US$ 0.1 million to US$ 1 million.

Agriculture Sector

1. To decrease transaction and handling costs, a single window system to enable the export

of perishable agricultural produce has been launched. The system will include creation of

multi-functional nodal agencies to be recognized by APEDA.

Leather Sector

1. Leather sector shall be permitted re-export of unsold imported raw hides and skins and

semi-finished leather from public bonded warehouses, dependent on payment of 50% of

the applicable export duty.

2. Enhancement of FPS rate to 2% would also vitally benefit the leather sector.

Tea

1. Minimum value addition under Advance Authorisation Scheme for export of tea has been

decreased from the prevailing 100% to 50%.

2. DTA sale limit of immediate tea by EOU units has been enhanced from the prevailing 30%

to 50%.

3. Export of tea has been included under VKGUY Scheme benefits.

Pharmaceutical Sector

1. Export Obligation Period for Advance Authorization published with 6-APA as input has

been increased from the prevailing six months to 36 months, as is accessible for other

products.

2. Pharma sector has been widely covered under MLFPS for countries in Africa and Latin

America and for few countries in Oceania and Far East.

EOUs

1. EOUs have been permitted to sell products manufactured by them in DTA up to a limit of

90% instead of existing 75%, without altering the criteria of ‘similar goods’, inside the

total entitlement of 50% for DTA sale.

2. To offer clarity to the customs field formations, DOR shall issue a clarification to facilitate

the procurement of spares outside 5% by granite sector EOUs.

3. EOUs will now be permitted to procure finished goods for consolidation along with their

manufactured goods, subject to specific safeguards.

4. EOUs will now be permitted CENVAT Credit facility for the component of SAD and

Education Cess on DTA sale.

Simplification of Procedures

1. To enable duty-free import of samples by exporters, number of samples/pieces has been

enhanced from the prevailing 15 to 50. Customs clearance of such samples shall be based

242 LOVELY PROFESSIONAL UNIVERSITY