Page 131 - DCOM302_MANAGEMENT_ACCOUNTING

P. 131

Management Accounting

Notes 4. Since everything has some utility, analyse the cash flow statement analysis and explain its

various utilities.

5. Discuss the procedure of determining cash provided by operating activities. Give suitable

example to illustrate your answer.

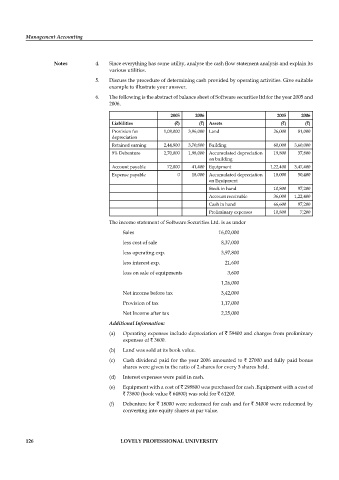

6. The following is the abstract of balance sheet of Software securities ltd for the year 2005 and

2006.

2005 2006 2005 2006

Liabilities (`) (`) Assets (`) (`)

Provision for 1,08,000 3,96,000 Land 26,000 81,000

depreciation

Retained earning 2,44,800 3,70,800 Building 60,000 3,60,000

9% Debenture 2,70,000 1,98,000 Accumulated depreciation 19,800 37,800

on building

Account payable 72,000 41,400 Equipment 1,22,400 3,47,400

Expense payable 0 18,000 Accumulated depreciation 18,000 50,400

on Equipment

Stock in hand 10,800 97,200

Account receivable 36,000 1,22,400

Cash in hand 66,600 97,200

Preliminary expenses 10,800 7,200

The income statement of Software Securities Ltd. is as under

Sales 16,02,000

less cost of sale 8,37,000

less operating exp. 3,97,800

less interest exp. 21,600

loss on sale of equipments 3,600

1,26,000

Net income before tax 3,42,000

Provision of tax 1,17,000

Net Income after tax 2,25,000

Additional Information:

(a) Operating expenses include depreciation of ` 59400 and charges from preliminary

expenses of ` 3600.

(b) Land was sold at its book value.

(c) Cash dividend paid for the year 2006 amounted to ` 27000 and fully paid bonus

shares were given in the ratio of 2 shares for every 3 shares held.

(d) Interest expenses were paid in cash.

(e) Equipment with a cost of ` 298800 was purchased for cash .Equipment with a cost of

` 73800 (book value ` 64800) was sold for ` 61200.

(f) Debenture for ` 18000 were redeemed for cash and for ` 54000 were redeemed by

converting into equity shares at par value.

126 LOVELY PROFESSIONAL UNIVERSITY