Page 47 - DCOM302_MANAGEMENT_ACCOUNTING

P. 47

Management Accounting

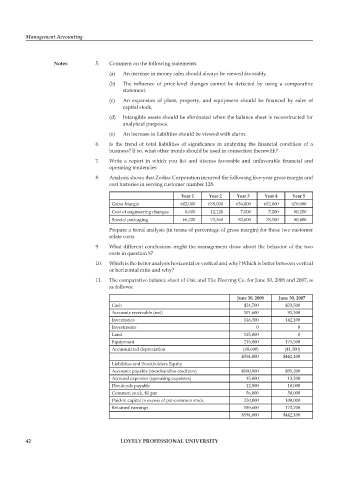

Notes 5. Comment on the following statements:

(a) An increase in money sales should always be viewed favorably.

(b) The influence of price-level changes cannot be detected by using a comparative

statement.

(c) An expansion of plant, property, and equipment should be financed by sales of

capital stock.

(d) Intangible assets should be eliminated when the balance sheet is reconstructed for

analytical purposes.

(e) An increase in liabilities should be viewed with alarm.

6. Is the trend of total liabilities of significance in analyzing the financial condition of a

business? If so, what other trends should be used in connection therewith?

7. Write a report in which you list and discuss favorable and unfavorable financial and

operating tendencies

8. Analysis shows that Zodiac Corporation incurred the following five-year gross margin and

cost histories in serving customer number 128.

Year 1 Year 2 Year 3 Year 4 Year 5

Gross Margin 602,000 638,000 636,000 652,000 670,000

Cost of engineering changes 6,600 12,120 7,000 7,200 80,250

Special packaging 66,200 73,360 82,600 78,100 80,400

Prepare a trend analysis (in terms of percentage of gross margin) for these two customer

relate costs.

9. What different conclusions might the management draw about the behavior of the two

costs in question 8?

10. Which is the better analysis horizontal or vertical and why? Which is better between vertical

or horizontal ratio and why?

11. The comparative balance sheet of Oak and Tile Flooring Co. for June 30, 2008 and 2007, is

as follows:

June 30, 2008 June 30, 2007

Cash $24,700 $23,500

Accounts receivable (net) 101,600 92,300

Inventories 146,300 142,100

Investments 0 0

Land 145,000 0

Equipment 215,000 175,500

Accumulated depreciation (48,600) (41,300)

$594,000 $442,100

Liabilities and Stockholders Equity

Accounts payable (merchandise creditors) $100,900 $95,200

Accrued expenses (operating expenses) 15,000 13,200

Dividends payable 12,500 10,000

Common stock, $1 par 56,000 50,000

Paid-in capital in excess of par-common stock 220,000 100,000

Retained earnings 189,600 173,700

$594,000 $442,100

42 LOVELY PROFESSIONAL UNIVERSITY