Page 60 - DCOM302_MANAGEMENT_ACCOUNTING

P. 60

Unit 4: Ratio Analysis

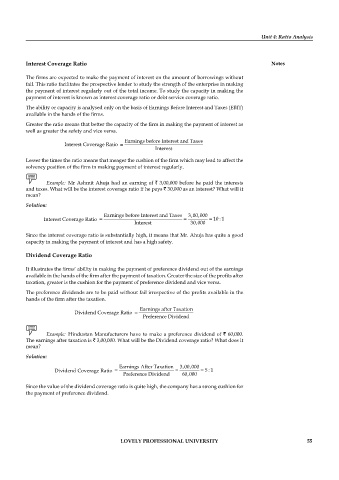

Interest Coverage Ratio Notes

The firms are expected to make the payment of interest on the amount of borrowings without

fail. This ratio facilitates the prospective lender to study the strength of the enterprise in making

the payment of interest regularly out of the total income. To study the capacity in making the

payment of interest is known as interest coverage ratio or debt service coverage ratio.

The ability or capacity is analysed only on the basis of Earnings Before Interest and Taxes (EBIT)

available in the hands of the fi rms.

Greater the ratio means that better the capacity of the firm in making the payment of interest as

well as greater the safety and vice versa.

Interest Coverage Ratio = Earnings before Interest and Taxes

Interest

Lesser the times the ratio means that meager the cushion of the firm which may lead to affect the

solvency position of the firm in making payment of interest regularly.

Example: Mr Ashmit Ahuja had an earning of ` 3,00,000 before he paid the interests

and taxes. What will be the interest coverage ratio if he pays ` 30,000 as an interest? What will it

mean?

Solution:

,

,

Interest Coverage Ratio = Earnings before Interest and Taxes = 3 00 000 = = 10 1

:

Interest 30 000

,

Since the interest coverage ratio is substantially high, it means that Mr. Ahuja has quite a good

capacity in making the payment of interest and has a high safety.

Dividend Coverage Ratio

It illustrates the firms’ ability in making the payment of preference dividend out of the earnings

available in the hands of the firm after the payment of taxation. Greater the size of the profi ts after

taxation, greater is the cushion for the payment of preference dividend and vice versa.

The preference dividends are to be paid without fail irrespective of the profits available in the

hands of the firm after the taxation.

Dividend Coverage Ratio = Earnings after Taxation

Preference Dividend

Example: Hindustan Manufacturers have to make a preference dividend of ` 60,000.

The earnings after taxation is ` 3,00,000. What will be the Dividend coverage ratio? What does it

mean?

Solution:

Earnings After Taxation 3 00 000

,

,

Dividend Coverage Ratio = = = = 51

:

Preference Dividend 60 000

,

Since the value of the dividend coverage ratio is quite high, the company has a strong cushion for

the payment of preference dividend.

LOVELY PROFESSIONAL UNIVERSITY 55