Page 212 - DCOM404_CORPORATE_LEGAL_FRAMEWORK

P. 212

Unit 10: Share Capital

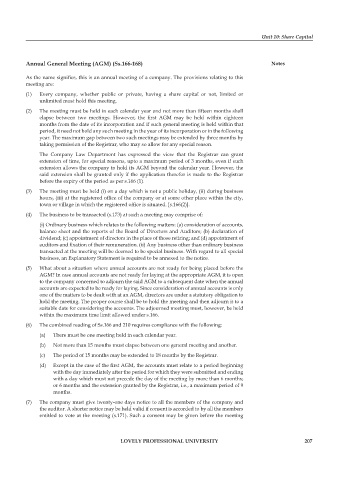

Annual General Meeting (AGM) (Ss.166-168) Notes

As the name signifies, this is an annual meeting of a company. The provisions relating to this

meeting are:

(1) Every company, whether public or private, having a share capital or not, limited or

unlimited must hold this meeting.

(2) The meeting must be held in each calendar year and not more than fifteen months shall

elapse between two meetings. However, the first AGM may be held within eighteen

months from the date of its incorporation and if such general meeting is held within that

period, it need not hold any such meeting in the year of its incorporation or in the following

year. The maximum gap between two such meetings may be extended by three months by

taking permission of the Registrar, who may so allow for any special reason.

The Company Law Department has expressed the view that the Registrar can grant

extension of time, for special reasons, upto a maximum period of 3 months, even if such

extension allows the company to hold its AGM beyond the calendar year. However, the

said extension shall be granted only if the application therefor is made to the Registrar

before the expiry of the period as per s.166 (1).

(3) The meeting must be held (i) on a day which is not a public holiday, (ii) during business

hours, (iii) at the registered office of the company or at some other place within the city,

town or village in which the registered office is situated. [s.166(2)].

(4) The business to be transacted (s.173) at such a meeting may comprise of:

(i) Ordinary business which relates to the following matters: (a) consideration of accounts,

balance sheet and the reports of the Board of Directors and Auditors; (b) declaration of

dividend; (c) appointment of directors in the place of those retiring; and (d) appointment of

auditors and fixation of their remuneration. (ii) Any business other than ordinary business

transacted at the meeting will be deemed to be special business. With regard to all special

business, an Explanatory Statement is required to be annexed to the notice.

(5) What about a situation where annual accounts are not ready for being placed before the

AGM? In case annual accounts are not ready for laying at the appropriate AGM, it is open

to the company concerned to adjourn the said AGM to a subsequent date when the annual

accounts are expected to be ready for laying. Since consideration of annual accounts is only

one of the matters to be dealt with at an AGM, directors are under a statutory obligation to

hold the meeting. The proper course shall be to hold the meeting and then adjourn it to a

suitable date for considering the accounts. The adjourned meeting must, however, be held

within the maximum time limit allowed under s.166.

(6) The combined reading of Ss.166 and 210 requires compliance with the following:

(a) There must be one meeting held in each calendar year.

(b) Not more than 15 months must elapse between one general meeting and another.

(c) The period of 15 months may be extended to 18 months by the Registrar.

(d) Except in the case of the fi rst AGM, the accounts must relate to a period beginning

with the day immediately after the period for which they were submitted and ending

with a day which must not precede the day of the meeting by more than 6 months;

or 6 months and the extension granted by the Registrar, i.e., a maximum period of 9

months.

(7) The company must give twenty-one days notice to all the members of the company and

the auditor. A shorter notice may be held valid if consent is accorded to by all the members

entitled to vote at the meeting (s.171). Such a consent may be given before the meeting

LOVELY PROFESSIONAL UNIVERSITY 207