Page 221 - DCOM404_CORPORATE_LEGAL_FRAMEWORK

P. 221

Corporate Legal Framework

Notes Cost Audit

Section 233B empowers the Central Government to issue necessary directions for conducting

Cost Audit of companies engaged in production, processing, manufacturing or mining activities.

The manner of conducting cost audit of a particular company may be specified in the order of

the Government.

The cost audit can be conducted by a Cost Accountant within the meaning of the Cost and Works

Accountants Act, 1959. However, a chartered accountant can also conduct cost audit if suffi cient

number of cost auditors are not available and the Central Government issues a notifi cation to

this effect.

The cost auditor can be appointed by the Board of Directors in accordance with the provisions

of s.224(B) and with the previous approval of the Central Government. The appointment of any

person as cost auditor of a company who is in full-time employment elsewhere is also prohibited.

The ceilings on number of audits are also applicable to a cost auditor as in the case of fi nancial

auditor under s.224. An auditor of the company cannot be appointed cost auditor. Also a person

who is disqualified as an auditor is also disqualified for appointment as cost auditor. Further, if

the cost auditor, after his appointment as such suffers from any of the disqualifications, he must

cease to act as cost auditor. The provisions of s.224 shall also apply in relation to a cost auditor.

The cost auditor shall make a report in relation to the audit conducted by him to the Central

Government and send a copy of the report to the company.

Dividends

All the profits of a company are not available for distribution amongst the shareholders. Only

the divisible profits which are determined in accordance with legal provisions are available for

distribution. Some of the more important provisions regarding dividends are:

(1) No dividend shall be declared or paid for any financial year except out of profit of the

current year or of the previous years.

(2) The company must provide for depreciation (including arrears of depreciation – as per

Department of Company Affairs clarification) before declaring dividends.

(3) Dividends can be paid in cash only. (Payment of dividend by cheque or dividend warrant

amounts to payment of dividend in cash). However, capitalisation of profits or reserves for

the purpose of issuing fully paid-up bonus shares is allowed.

(4) Capital profits can also be distributed by way of dividend but only if (i) the capital profi ts

are realised; (ii) the capital profits remain after the revaluation of all the assets; and (iii) the

distribution of a dividend of such profits is permitted by the company’s articles.

(5) The company must transfer from the profits to its reserves the following minimum amount;

before declaring dividends, at the rates mentioned below:

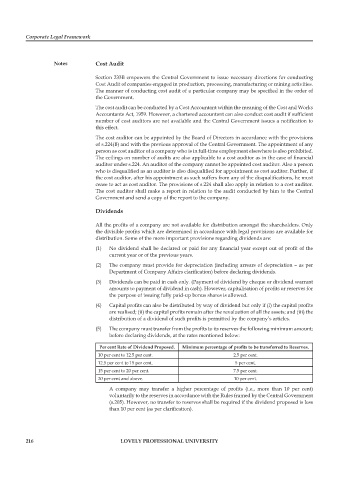

Per cent Rate of Dividend Proposed. Minimum percentage of profits to be transferred to Reserves.

10 per cent to 12.5 per cent. 2.5 per cent.

12.5 per cent to 15 per cent. 5 per cent.

15 per cent to 20 per cent. 7.5 per cent.

20 per cent and above. 10 per cent.

A company may transfer a higher percentage of profits (i.e., more than 10 per cent)

voluntarily to the reserves in accordance with the Rules framed by the Central Government

(s.205). However, no transfer to reserves shall be required if the dividend proposed is less

than 10 per cent (as per clarifi cation).

216 LOVELY PROFESSIONAL UNIVERSITY