Page 23 - DCOM409_CONTEMPORARY_ACCOUNTING

P. 23

Contemporary Accounting

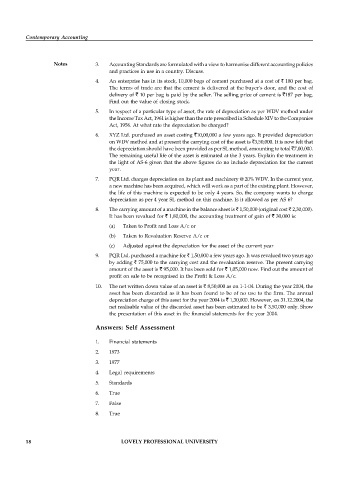

Notes 3. Accounting Standards are formulated with a view to harmonise different accounting policies

and practices in use in a country. Discuss.

4. An enterprise has in its stock, 10,000 bags of cement purchased at a cost of ` 180 per bag.

The terms of trade are that the cement is delivered at the buyer’s door, and the cost of

delivery of ` 10 per bag is paid by the seller. The selling price of cement is `187 per bag.

Find out the value of closing stock.

5. In respect of a particular type of asset, the rate of depreciation as per WDV method under

the Income Tax Act, 1961 is higher than the rate prescribed in Schedule XIV to the Companies

Act, 1956. At what rate the depreciation be charged?

6. XYZ Ltd. purchased an asset costing `10,00,000 a few years ago. It provided depreciation

on WDV method and at present the carrying cost of the asset is `3,50,000. It is now felt that

the depreciation should have been provided as per SL method, amounting to total `7,00,000.

The remaining useful life of the asset is estimated at the 3 years. Explain the treatment in

the light of AS-6 given that the above figures do no include depreciation for the current

year.

7. PQR Ltd. charges depreciation on its plant and machinery @ 20% WDV. In the current year,

a new machine has been acquired, which will work as a part of the existing plant. However,

the life of this machine is expected to be only 4 years. So, the company wants to charge

depreciation as per 4 year SL method on this machine. Is it allowed as per AS 6?

8. The carrying amount of a machine in the balance sheet is ` 1,50,000 (original cost ` 2,30,000).

It has been revalued for ` 1,80,000, the accounting treatment of gain of ` 30,000 is:

(a) Taken to Profit and Loss A/c or

(b) Taken to Revaluation Reserve A/c or

(c) Adjusted against the depreciation for the asset of the current year

9. PQR Ltd. purchased a machine for ` 1,50,000 a few years ago. It was revalued two years ago

by adding ` 75,000 to the carrying cost and the revaluation reserve. The present carrying

amount of the asset is ` 95,000. It has been sold for ` 1,05,000 now. Find out the amount of

profit on sale to be recognised in the Profit & Loss A/c.

10. The net written down value of an asset is ` 8,50,000 as on 1-1-04. During the year 2004, the

asset has been discarded as it has been found to be of no use to the firm. The annual

depreciation charge of this asset for the year 2004 is ` 1,30,000. However, on 31.12.2004, the

net realisable value of the discarded asset has been estimated to be ` 3,50,000 only. Show

the presentation of this asset in the financial statements for the year 2004.

Answers: Self Assessment

1. Financial statements

2. 1973

3. 1977

4. Legal requirements

5. Standards

6. True

7. False

8. True

18 LOVELY PROFESSIONAL UNIVERSITY