Page 299 - DCOM304_INDIAN_FINANCIAL_SYSTEM

P. 299

Indian Financial System

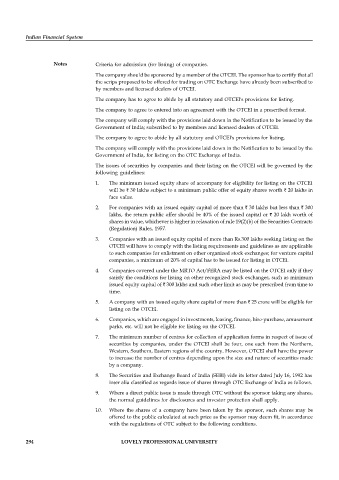

Notes Criteria for admission (for listing) of companies.

The company should be sponsored by a member of the OTCEI. The sponsor has to certify that all

the scrips proposed to be offered for trading on OTC Exchange have already been subscribed to

by members and licensed dealers of OTCEI.

The company has to agree to abide by all statutory and OTCEI's provisions for listing.

The company to agree to entered into an agreement with the OTCEI in a prescribed format.

The company will comply with the provisions laid down in the Notification to be issued by the

Government of India; subscribed to by members and licensed dealers of OTCEI.

The company to agree to abide by all statutory and OTCEI's provisions for listing.

The company will comply with the provisions laid down in the Notification to be issued by the

Government of India, for listing on the OTC Exchange of India.

The issues of securities by companies and their listing on the OTCEI will be governed by the

following guidelines:

1. The minimum issued equity share of accompany for eligibility for listing on the OTCEI

will be ` 30 lakhs subject to a minimum public offer of equity shares worth ` 20 lakhs in

face value.

2. For companies with an issued equity capital of more than ` 30 lakhs but less than ` 300

lakhs, the return public offer should be 40% of the issued capital or ` 20 lakh worth of

shares in value, whichever is higher in relaxation of rule 19(2)(b) of the Securities Contracts

(Regulation) Rules, 1957.

3. Companies with an issued equity capital of more than Rs.300 lakhs seeking listing on the

OTCEI will have to comply with the listing requirements and guidelines as are applicable

to such companies for enlistment on other organized stock exchanges; for venture capital

companies, a minimum of 20% of capital has to be issued for listing in OTCEI.

4. Companies covered under the MRTO Act/FERA may be listed on the OTCEI only if they

satisfy the conditions for listing on other recognized stock exchanges, such as minimum

issued equity capital of ` 300 lakhs and such other limit as may be prescribed from time to

time.

5. A company with an issued equity share capital of more than ` 25 crore will be eligible for

listing on the OTCEI.

6. Companies, which are engaged in investments, leasing, finance, hire-purchase, amusement

parks, etc. will not be eligible for listing on the OTCEI.

7. The minimum number of centres for collection of application forms in respect of issue of

securities by companies, under the OTCEI shall be four, one each from the Northern,

Western, Southern, Eastern regions of the country. However, OTCEI shall have the power

to increase the number of centres depending upon the size and nature of securities made

by a company.

8. The Securities and Exchange Board of India (SEBI) vide its letter dated July 16, 1992 has

inter alia classified as regards issue of shares through OTC Exchange of India as follows.

9. Where a direct public issue is made through OTC without the sponsor taking any shares,

the normal guidelines for disclosures and investor protection shall apply.

10. Where the shares of a company have been taken by the sponsor, such shares may be

offered to the public calculated at such price as the sponsor may deem fit, in accordance

with the regulations of OTC subject to the following conditions.

294 LOVELY PROFESSIONAL UNIVERSITY