Page 196 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 196

Unit 11: Warehousing and Duty Drawback

The eligible importer then submits the request form (Form Kor Sor Kor 131) and all supporting Notes

documents to Customs. Thai Customs has set standard for granting an approval within one day

of receipt of all necessary documents and information as well as verification of financial obligation

and record of past offence. If additional information is not submitted promptly upon the request

of Customs, Thai Customs cannot guarantee that the approval will be granted within one days.

Self Assessment

Fill in the blanks:

11. ........................................warehouses to contain only goods belonging to warehouse owner

or held by him as a broker or a commission agent and only goods on which duty has not

been paid.

12. Every ....................................person of a private warehouse shall maintain proper records of

all entries into, operations in, and removals of goods from his warehouse indicating

among other particular, the quantity, value, rate and amount of duty.

13. The consignor shall also prepare an invoice in the manner specified in ....................................of

the said Rules in respect of the goods proposed to be removed from his factory or warehouse.

14. The Superintendent-in-charge of the consignee shall .................................... the application

received by him and send it to the Superintendent-in-charge of the consignor.

15. A .................................... shall be used solely for storing excisable goods belonging to the

registered person of the warehouse alone

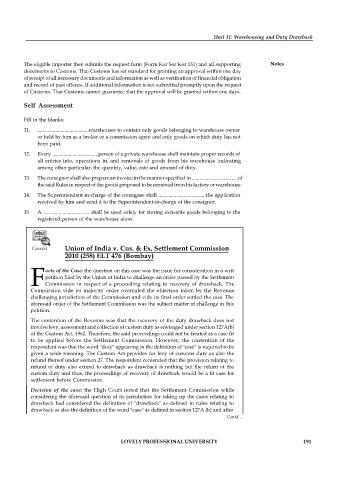

Caselet Union of India v. Cus. & Ex. Settlement Commission

2010 (258) ELT 476 (Bombay)

acts of the Case: the question on this case was the issue for consideration in a writ

petition filed by the Union of India to challenge an order passed by the Settlement

FCommission in respect of a proceeding relating to recovery of drawback. The

Commission vide its majority order overruled the objection taken by the Revenue

challenging jurisdiction of the Commission and vide its final order settled the case. The

aforesaid order of the Settlement Commission was the subject matter of challenge in this

petition.

The contention of the Revenue was that the recovery of the duty drawback does not

involve levy, assessment and collection of custom duty as envisaged under section 127A(b)

of the Custom Act, 1962. Therefore, the said proceedings could not be treated as a case fit

to be applied before the Settlement Commission. However, the contention of the

respondent was that the word "duty" appearing in the definition of "case" is required to be

given a wide meaning. The Custom Act provides for levy of customs duty as also the

refund thereof under section 27. The respondent contended that the provision relating to

refund of duty also extend to drawback as drawback is nothing but the return of the

custom duty and thus, the proceedings of recovery of drawback would be a fit case for

settlement before Commission.

Decision of the case: the High Court noted that the Settlement Commission while

considering the aforesaid question of its jurisdiction for taking up the cases relating to

drawback had considered the definition of "drawback" as defined in rules relating to

drawback as also the definition of the word "case" as defined in section 127A (b) and after

Contd....

LOVELY PROFESSIONAL UNIVERSITY 191