Page 219 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 219

Indirect Tax Laws

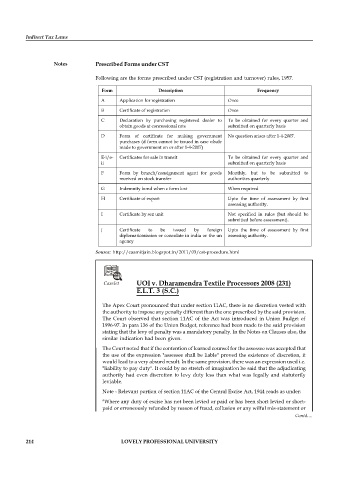

Notes Prescribed Forms under CST

Following are the forms prescribed under CST (registration and turnover) rules, 1957.

Form Description Frequency

A Application for registration Once

B Certificate of registration Once

C Declaration by purchasing registered dealer to To be obtained for every quarter and

obtain goods at concessional rate submitted on quarterly basis

D Form of certificate for making government No question arises after 1-4-2007.

purchases (d form cannot be issued in case ofsale

made to government on or after 1-4-2007)

E-i/e- Certificates for sale in transit To be obtained for every quarter and

ii submitted on quarterly basis

F Form by branch/consignment agent for goods Monthly, but to be submitted to

received on stock transfer authorities quarterly

G Indemnity bond when c form lost When required

H Certificate of export Upto the time of assessment by first

assessing authority.

I Certificate by sez unit Not specified in rules (but should be

submitted before assessment).

J Certificate to be issued by foreign Upto the time of assessment by first

diplomaticmission or consulate in india or the un assessing authority.

agency

Source: http://caamitjain.blogspot.in/2011/03/cst-procedure.html

Caselet UOI v. Dharamendra Textile Processors 2008 (231)

E.L.T. 3 (S.C.)

The Apex Court pronounced that under section 11AC, there is no discretion vested with

the authority to impose any penalty different than the one prescribed by the said provision.

The Court observed that section 11AC of the Act was introduced in Union Budget of

1996-97. In para 136 of the Union Budget, reference had been made to the said provision

stating that the levy of penalty was a mandatory penalty. In the Notes on Clauses also, the

similar indication had been given.

The Court noted that if the contention of learned counsel for the assessee was accepted that

the use of the expression "assessee shall be liable" proved the existence of discretion, it

would lead to a very absurd result. In the same provision, there was an expression used i.e.

"liability to pay duty". It could by no stretch of imagination be said that the adjudicating

authority had even discretion to levy duty less than what was legally and statutorily

leviable.

Note - Relevant portion of section 11AC of the Central Excise Act, 1944 reads as under:

"Where any duty of excise has not been levied or paid or has been short levied or short-

paid or erroneously refunded by reason of fraud, collusion or any wilful mis-statement or

Contd....

214 LOVELY PROFESSIONAL UNIVERSITY