Page 241 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 241

Indirect Tax Laws

Notes

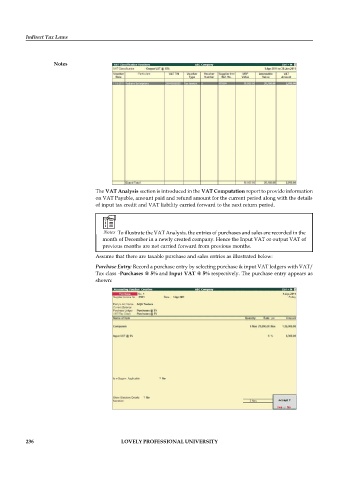

The VAT Analysis section is introduced in the VAT Computation report to provide information

on VAT Payable, amount paid and refund amount for the current period along with the details

of input tax credit and VAT liability carried forward to the next return period.

Notes To illustrate the VAT Analysis, the entries of purchases and sales are recorded in the

month of December in a newly created company. Hence the Input VAT or output VAT of

previous months are not carried forward from previous months.

Assume that there are taxable purchase and sales entries as illustrated below:

Purchase Entry: Record a purchase entry by selecting purchase & input VAT ledgers with VAT/

Tax class -Purchases @ 5% and Input VAT @ 5% respectively. The purchase entry appears as

shown:

236 LOVELY PROFESSIONAL UNIVERSITY