Page 250 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 250

Unit 14: Value Added Tax

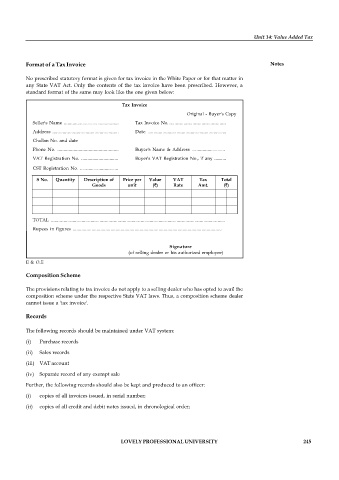

Format of a Tax Invoice Notes

No prescribed statutory format is given for tax invoice in the White Paper or for that matter in

any State VAT Act. Only the contents of the tax invoice have been prescribed. However, a

standard format of the same may look like the one given below:

Tax Invoice

Original - Buyer's Copy

Seller's Name ............................................ Tax Invoice No. ............................................

Address .................................................... Date: .............................................................

Challan No. and date

Phone No. ................................................. Buyer's Name & Address ...........................

VAT Registration No. .............................. Buyer's VAT Registration No., if any ..........

CST Registration No. ...............................

S No. Quantity Description of Price per Value VAT Tax Total

Goods unit ( ) Rate Amt. ( )

TOTAL ........................................................................................................................................

Rupees in figures ......................................................................................................................

Signature

(of selling dealer or his authorized employee)

E & O.E

Composition Scheme

The provisions relating to tax invoice do not apply to a selling dealer who has opted to avail the

composition scheme under the respective State VAT laws. Thus, a composition scheme dealer

cannot issue a 'tax invoice'.

Records

The following records should be maintained under VAT system:

(i) Purchase records

(ii) Sales records

(iii) VAT account

(iv) Separate record of any exempt sale

Further, the following records should also be kept and produced to an officer:

(i) copies of all invoices issued, in serial number;

(ii) copies of all credit and debit notes issued, in chronological order;

LOVELY PROFESSIONAL UNIVERSITY 245