Page 78 - DCOM308_DCOM502_INDIRECT_TAX_LAWS

P. 78

Unit 5: Clearances of Excisable Goods

(i) send to the officer with whom rebate claim is to be filed, either by post or by handing over to Notes

the exporter in a tamper proof sealed cover after posting the particulars in official records, or

(ii) send to the Excise Rebate Audit Section at the place of export in case rebate is to be claimed

by electronic declaration on Electronic Data Inter-change system of Customs.

(c) The exporter may prepare quintuplicate copy of application for claiming any other export

incentive. This copy shall be dealt in the same manner as the original copy of application.

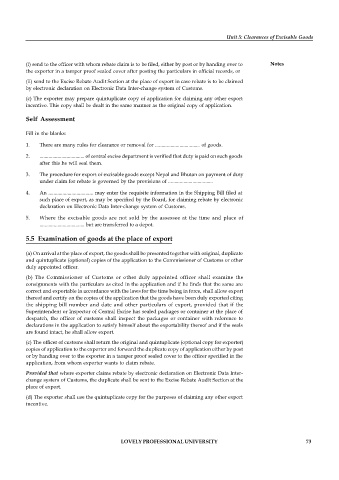

Self Assessment

Fill in the blanks:

1. There are many rules for clearance or removal for ................................... of goods.

2. ................................... of central excise department is verified that duty is paid on such goods

after this he will seal them.

3. The procedure for export of excisablegoods except Nepal and Bhutan on payment of duty

under claim for rebate is governed by the provisions of ...................................

4. An ................................... may enter the requisite information in the Shipping Bill filed at

such place of export, as may be specified by the Board, for claiming rebate by electronic

declaration on Electronic Data Inter-change system of Customs.

5. Where the excisable goods are not sold by the assessee at the time and place of

................................... but are transferred to a depot.

5.5 Examination of goods at the place of export

(a) On arrival at the place of export, the goods shall be presented together with original, duplicate

and quintuplicate (optional) copies of the application to the Commissioner of Customs or other

duly appointed officer.

(b) The Commissioner of Customs or other duly appointed officer shall examine the

consignments with the particulars as cited in the application and if he finds that the same are

correct and exportable in accordance with the laws for the time being in force, shall allow export

thereof and certify on the copies of the application that the goods have been duly exported citing

the shipping bill number and date and other particulars of export, provided that if the

Superintendent or Inspector of Central Excise has sealed packages or container at the place of

despatch, the officer of customs shall inspect the packages or container with reference to

declarations in the application to satisfy himself about the exportability thereof and if the seals

are found intact, he shall allow export.

(c) The officer of customs shall return the original and quintuplicate (optional copy for exporter)

copies of application to the exporter and forward the duplicate copy of application either by post

or by handing over to the exporter in a tamper proof sealed cover to the officer specified in the

application, from whom exporter wants to claim rebate.

Provided that where exporter claims rebate by electronic declaration on Electronic Data Inter-

change system of Customs, the duplicate shall be sent to the Excise Rebate Audit Section at the

place of export.

(d) The exporter shall use the quintuplicate copy for the purposes of claiming any other export

incentive.

LOVELY PROFESSIONAL UNIVERSITY 73