Page 116 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 116

Unit 4: Fundamental Analysis

though. Please remember, the use of an analytical framework does not guarantee an actual Notes

decision. However, it does guarantee an informed and considered investment decision, which

would hopefully be better as it based on relevant and crucial information.

Fundamental Analysis and Efficient Market

Before elaborating in detail on the economy-industry-company framework, it is pertinent to

mention that doubts are expressed about the utility of this approach in the contest of efficient

stock market set-up. Briefly, the market efficiency relates to the speed with which the stock

market incorporates the information about the economy, industry and company, in the share

prices, rather instantaneously. The above given view about share market efficiency implies that

no one would be able to make abnormal profits given such a set-up. Some research studies in the

literature also support the above view. Practitioners, however, do not agree to such conclusions

of an empirical nature.

Fundamental Analysis and Chemistry of Earnings

The logic for fundamental analysis becomes crystal clear once we understand the chemistry of

earnings and macro and macro factors which influence the future of earnings.

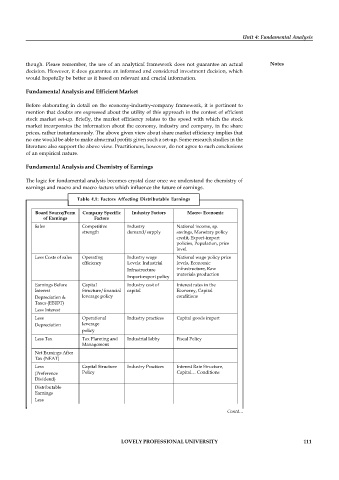

Table 4.1: Factors Affecting Distributable Earnings

Board Source/Form Company Specific Industry Factors Macro- Economic

of Earnings Factors

Sales Competitive Industry National income, sp.

strength demand/supply savings, Monetary policy

credit, Export-import

policies, Population, price

level.

Less Costs of sales Operating Industry wage National wage policy price

efficiency Levels: Industrial levels, Economic

Infrastructure infrastructure, Raw

materials production

Import-export policy

Earnings Before Capital Industry cost of Interest rates in the

Interest Structure/financial capital Economy, Capital

Depreciation & leverage policy conditions

Taxes (EBIDT)

Less Interest

Less Operational Industry practices Capital goods import

Depreciation leverage

policy

Less Tax Tax Planning and Industrial lobby Fiscal Policy

Management

Net Earnings After

Tax (NEAT)

Less Capital Structure Industry Practices Interest Rate Structure,

(Preference Policy Capital… Conditions

Dividend)

Distributable

Earnings

Less

Equity Dividend Dividend Policy Industry Practices Fiscal Policy, Credit Capital

Market conditions Contd...

Retained Earnings

LOVELY PROFESSIONAL UNIVERSITY 111