Page 168 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 168

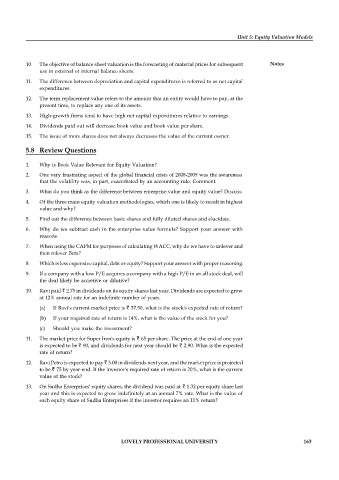

Unit 5: Equity Valuation Models

10. The objective of balance sheet valuation is the forecasting of material prices for subsequent Notes

use in external or internal balance sheets.

11. The difference between depreciation and capital expenditures is referred to as net capital

expenditures.

12. The term replacement value refers to the amount that an entity would have to pay, at the

present time, to replace any one of its assets.

13. High-growth firms tend to have high net capital expenditures relative to earnings.

14. Dividends paid out will decrease book value and book value per share.

15. The issue of more shares does not always decreases the value of the current owner.

5.8 Review Questions

1. Why is Book Value Relevant for Equity Valuation?

2. One very frustrating aspect of the global financial crisis of 2008-2009 was the awareness

that the volatility was, in part, exacerbated by an accounting rule. Comment.

3. What do you think as the difference between enterprise value and equity value? Discuss.

4. Of the three main equity valuation methodologies, which one is likely to result in highest

value and why?

5. Find out the difference between basic shares and fully diluted shares and elucidate.

6. Why do we subtract cash in the enterprise value formula? Support your answer with

reasons.

7. When using the CAPM for purposes of calculating WACC, why do we have to unlever and

then relever Beta?

8. Which is less expensive capital, debt or equity? Support your answer with proper reasoning.

9. If a company with a low P/E acquires a company with a high P/E in an all stock deal, will

the deal likely be accretive or dilutive?

10. Ravi paid 2.75 in dividends on its equity shares last year. Dividends are expected to grow

at 12% annual rate for an indefinite number of years.

(a) If Ravi's current market price is 37.50, what is the stock's expected rate of return?

(b) If your required rate of return is 14%, what is the value of the stock for you?

(c) Should you make the investment?

11. The market price for Super Iron's equity is 65 per share. The price at the end of one year

is expected to be 90, and dividends for next year should be 2.90. What is the expected

rate of return?

12. Ravi Petro is expected to pay 3.00 in dividends next year, and the market price is projected

to be 75 by year-end. If the investor's required rate of return is 20%, what is the current

value of the stock?

13. On Sudha Enterprises' equity shares, the dividend was paid at 1.32 per equity share last

year and this is expected to grow indefinitely at an annual 7% rate. What is the value of

each equity share of Sudha Enterprises if the investor requires an 11% return?

LOVELY PROFESSIONAL UNIVERSITY 163