Page 270 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 270

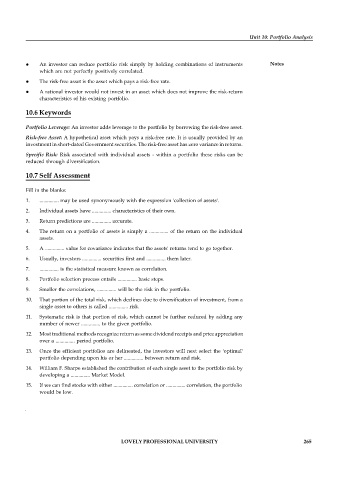

Unit 10: Portfolio Analysis

An investor can reduce portfolio risk simply by holding combinations of instruments Notes

which are not perfectly positively correlated.

The risk-free asset is the asset which pays a risk-free rate.

A rational investor would not invest in an asset which does not improve the risk-return

characteristics of his existing portfolio.

10.6 Keywords

Portfolio Leverage: An investor adds leverage to the portfolio by borrowing the risk-free asset.

Risk-free Asset: A hypothetical asset which pays a risk-free rate. It is usually provided by an

investment in short-dated Government securities. The risk-free asset has zero variance in returns.

Specific Risk: Risk associated with individual assets - within a portfolio these risks can be

reduced through diversification.

10.7 Self Assessment

Fill in the blanks:

1. ............... may be used synonymously with the expression 'collection of assets'.

2. Individual assets have ............... characteristics of their own.

3. Return predictions are ............... accurate.

4. The return on a portfolio of assets is simply a ............... of the return on the individual

assets.

5. A ............... value for covariance indicates that the assets' returns tend to go together.

6. Usually, investors ............... securities first and ............... them later.

7. ............... is the statistical measure known as correlation.

8. Portfolio selection process entails ............... basic steps.

9. Smaller the correlations, ............... will be the risk in the portfolio.

10. That portion of the total risk, which declines due to diversification of investment, from a

single asset to others is called ............... risk.

11. Systematic risk is that portion of risk, which cannot be further reduced by adding any

number of newer ............... to the given portfolio.

12. Most traditional methods recognize return as some dividend receipts and price appreciation

over a ............... period portfolio.

13. Once the efficient portfolios are delineated, the investors will next select the 'optimal'

portfolio depending upon his or her ............... between return and risk.

14. William F. Sharpe established the contribution of each single asset to the portfolio risk by

developing a ............... Market Model.

15. If we can find stocks with either ............... correlation or ............... correlation, the portfolio

would be low.

LOVELY PROFESSIONAL UNIVERSITY 265