Page 26 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 26

Unit 2: Planning of Working Capital

Notes

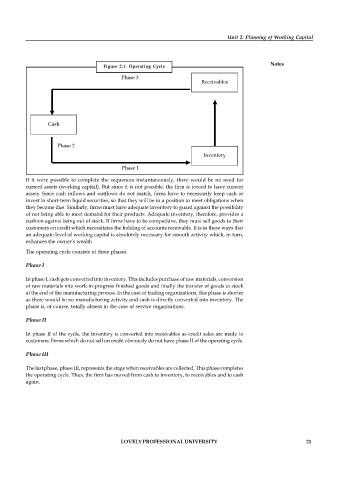

Figure 2.1: Operating Cycle

Phase 3

Receivables

Cash

Phase 2

Inventory

Phase 1

If it were possible to complete the sequences instantaneously, there would be no need for

current assets (working capital). But since it is not possible, the firm is forced to have current

assets. Since cash inflows and outflows do not match, firms have to necessarily keep cash or

invest in short-term liquid securities, so that they will be in a position to meet obligations when

they become due. Similarly, firms must have adequate inventory to guard against the possibility

of not being able to meet demand for their products. Adequate inventory, therefore, provides a

cushion against being out of stock. If firms have to be competitive, they must sell goods to their

customers on credit which necessitates the holding of accounts receivable. It is in these ways that

an adequate level of working capital is absolutely necessary for smooth activity which, in turn,

enhances the owner’s wealth.

The operating cycle consists of three phases.

Phase I

In phase I, cash gets converted into inventory. This includes purchase of raw materials, conversion

of raw materials into work-in-progress finished goods and finally the transfer of goods to stock

at the end of the manufacturing process. In the case of trading organizations, this phase is shorter

as there would be no manufacturing activity and cash is directly converted into inventory. The

phase is, of course, totally absent in the case of service organisations.

Phase II

In phase II of the cycle, the inventory is converted into receivables as credit sales are made to

customers. Firms which do not sell on credit obviously do not have phase II of the operating cycle.

Phase III

The last phase, phase III, represents the stage when receivables are collected. This phase completes

the operating cycle. Thus, the firm has moved from cash to inventory, to receivables and to cash

again.

LOVELY PROFESSIONAL UNIVERSITY 21