Page 175 - DCOM506_DMGT502_STRATEGIC_MANAGEMENT

P. 175

Unit 9: Strategic Analysis and Choice

to have a high share of a slow growth market. With regards to the PepsiCo, services that Notes

can be considered in the cash cows are the Quaker. Lastly, it can be seen that Tropicana,

Gatorade and Frito-Lay are products that can be considered in the dogs' category.

It can be said that PepsiCo has been able to market their products and increase their

market share and market growth by using different strategies and approaches. The

company enhances the market share of their brands by considering different marketing

entry modes. Through collaborative venture PepsiCo has been able to se merger and

acquisition along with joint venture approach. Furthermore, franchising is another method

that PepsiCo used to enhance the market share of the brands of the company. This model

has been utilized by PepsiCo in order to expand its business portfolio in other regions in

the world. In this manner, the management of PepsiCo considers franchising an existing

company in an international market while applying the methods of collaborative venture.

In order to make this foreign operational mode combination a success, PepsiCo consider

the most suitable and effective expansion strategy. It can be said that the spread of PepsiCo

is truly global. The company has hundreds of brands, which can be found in almost 200

countries and territories around the world.

Questions

1. Does every company have all the four categories of the BCG matrix?

2. What do you suggest to put the question marks of Pepsi in the Cow category? Will

it be feasible for the company? Why/why not?

Source: ivythesis.typepad.com

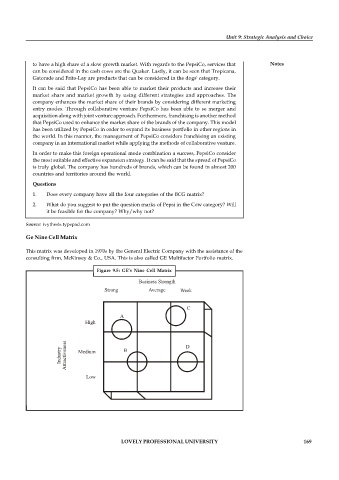

Ge Nine Cell Matrix

This matrix was developed in 1970s by the General Electric Company with the assistance of the

consulting firm, McKinsey & Co., USA. This is also called GE Multifactor Portfolio matrix.

Figure 9.5: GE’s Nine Cell Matrix

Business Strength

Strong Average Week

C

A

High

Industry Attractiveness Medium B D

Low

LOVELY PROFESSIONAL UNIVERSITY 169