Page 181 - DCOM506_DMGT502_STRATEGIC_MANAGEMENT

P. 181

Unit 9: Strategic Analysis and Choice

Notes

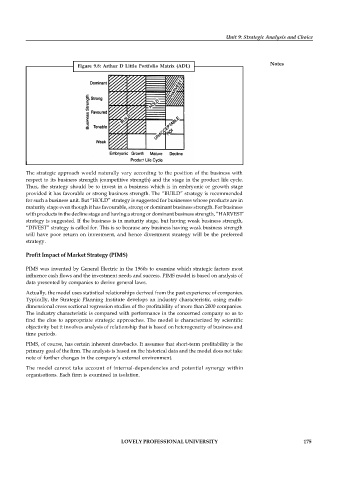

Figure 9.8: Arthur D Little Portfolio Matrix (ADL)

The strategic approach would naturally vary according to the position of the business with

respect to its business strength (competitive strength) and the stage in the product life cycle.

Thus, the strategy should be to invest in a business which is in embryonic or growth stage

provided it has favorable or strong business strength. The “BUILD” strategy is recommended

for such a business unit. But “HOLD” strategy is suggested for businesses whose products are in

maturity stage even though it has favourable, strong or dominant business strength. For business

with products in the decline stage and having a strong or dominant business strength, “HARVEST’

strategy is suggested. If the business is in maturity stage, but having weak business strength,

“DIVEST” strategy is called for. This is so because any business having weak business strength

will have poor return on investment, and hence divestment strategy will be the preferred

strategy.

Profit Impact of Market Strategy (PIMS)

PIMS was invented by General Electric in the 1960s to examine which strategic factors most

influence cash flows and the investment needs and success. PIMS model is based on analysis of

data presented by companies to derive general laws.

Actually, the model uses statistical relationships derived from the past experience of companies.

Typically, the Strategic Planning Institute develops an industry characteristic, using multi-

dimensional cross sectional regression studies of the profitability of more than 2000 companies.

The industry characteristic is compared with performance in the concerned company so as to

find the clue to appropriate strategic approaches. The model is characterized by scientific

objectivity but it involves analysis of relationship that is based on heterogeneity of business and

time periods.

PIMS, of course, has certain inherent drawbacks. It assumes that short-term profitability is the

primary goal of the firm. The analysis is based on the historical data and the model does not take

note of further changes in the company’s external environment.

The model cannot take account of internal-dependencies and potential synergy within

organisations. Each firm is examined in isolation.

LOVELY PROFESSIONAL UNIVERSITY 175